Your 401(k) probably won’t be enough to fund your entire retirement but it’s one of the main savings accounts available to Americans. At the very least, your 401(k) is a cornerstone account that will provide the foundation for your retirement. Contributions to 401(k)s are “use it or lose it” space which means that each year you have the chance to contribute to it and if you don’t, tough luck. There are no options to go back in time and make up those contributions.

Since you’ll likely need more than the amount in your 401(k) to fund retirement, it makes sense to get started maxing out this account as soon as you can. This is true whether you’re in Biglaw, a government attorney or working for a small practice. The sooner you “max out” this account the sooner you will forget that you’re maxing it out. Your default disposable income should be your salary minus the maximum contributions to a 401(k). Many lawyers may not be able to start out in this position but if you contribute as much as you can, and then bank your raises, nearly all lawyers should be in a position to max out their 401(k) within 3-5 years from law school assuming no lifestyle inflation and reasonable raises.

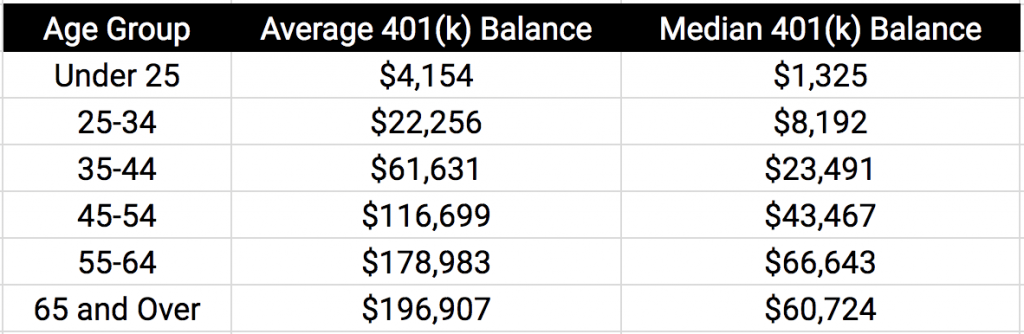

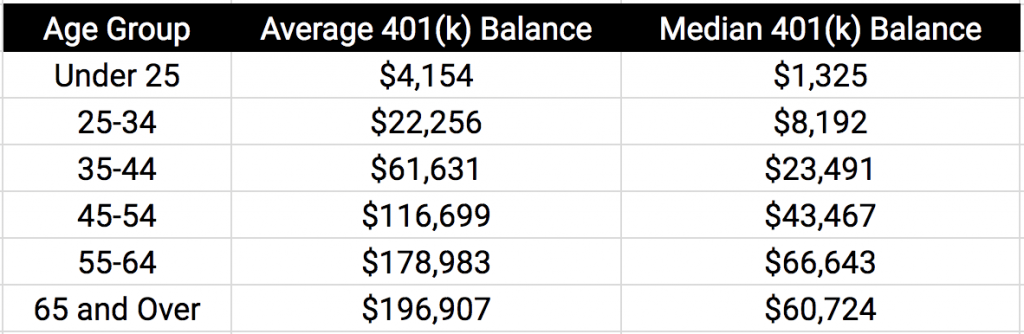

If you can do this, you will be far ahead of the average American, which only has $116,699 in the 45-54 age group according to Vanguard, one of the country’s largest managers of 401(k) accounts. The reality is that the “average” numbers are skewed heavily by the wealthy anyway. The median account balance for the 45-54 age group is a paltry $43,467. Lawyers should be aiming much higher.

If you’re curious how the wealthy are performing, Vanguard also breaks down retirement accounts by job tenure. Since even the super-rich are limited to the amount they can contribute to a 401(k) each year, the average 401(k) balance by job tenure is a better measure for a lawyer looking to measure themselves against the millionaires of the world.

The average 401(k) balance for someone 2-3 years into their job is $25,087 which means an average contribution of $10,034.8 during the first few years of your career (which includes some appreciation, although at this point in your accumulation phase your savings rate is much more important than you rate of return).

If you want to keep up with the average wealthy person, you need to at least hit these targets in your 401(k).

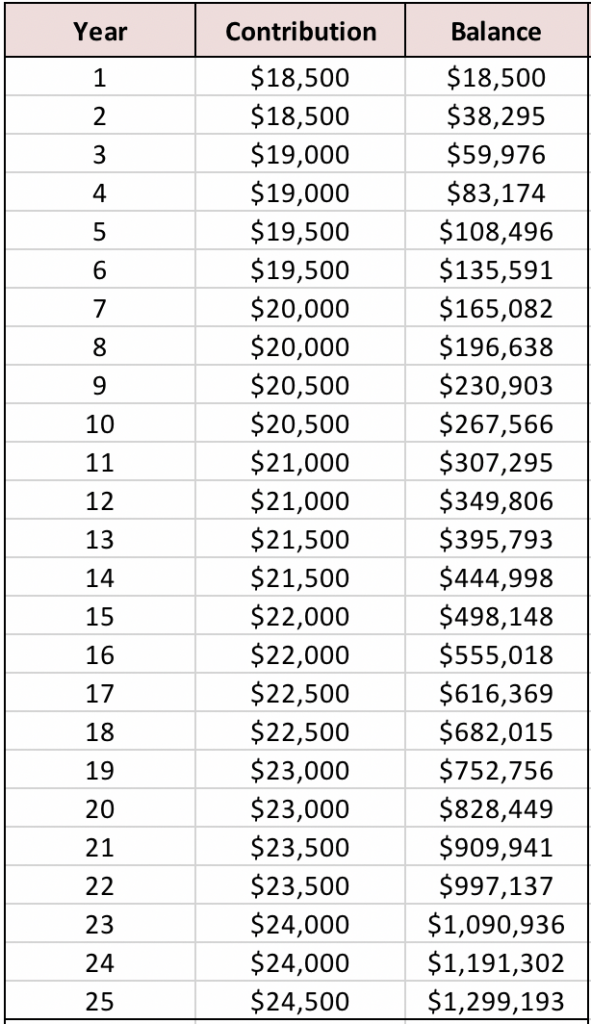

If you want to aim higher, becoming a 401(k) millionaire is a symbolic goal worthy of pursuing. What will you have to do to achieve it? Here’s an example of how a 401(k) millionaire could make it in a relatively short amount of time. I made assumptions that the account would return 7% annually and that contribution limits would go up by $500 every two years to keep pace with inflation. As you can see, after 23 years of contributions you should cross the threshold for 401(k) millionaire status.

That may seem like a long legal career but the truth is if you make 401(k) contributions a mandatory part of your career, you should be maxing out this account every year that you’re earning income. Even if you’re the early retiree that quits the law at 42, assuming that you’re living off savings in your taxable accounts, I would think all incidental earnings during your “retired” years would still get deposited into a 401(k) account to take advantage of the tax-protected status.

Regardless, if becoming a 401(k) millionaire is part of your path to wealth you’ll need to do these things:

- Start Early. There’s no time to waste. If a 30-year-old lawyer waits until she’s 35 to contribute to a 401(k) account, that lawyer will need to be working until 68 in order to hit millionaire status in your 401(k) account via contributions.

- Make it Mandatory. The sooner you can treat 401(k) contributions as a mandatory part of your salary, the quicker you’ll become a 401(k) millionaire. The truth is after you’ve done this for a couple of years you won’t even notice anyway. The 401(k) contributions are just an automatic part of your salary.

- Increase up to Maximum Quickly. If you’re a man, you’ll need to up your contributions quickly to the maximum. Women are already out-saving men in their 401(k) accounts. If you can’t max out your 401(k) right now, all salary increases and bonuses should be directed to your 401(k) until you hit that goal. There will be time for lifestyle inflation later. You can’t afford to miss out on 401(k) space by consuming those raises and bonuses now.

- Watch Out For Fees. Fees will eat up your return over time. A 1% annual fee may seem like a small amount but if you’re only earning 5% each year after inflation, does it seem reasonable to hand over 20% of your return to a company that should be managing your account with computer software? I don’t often promote Personal Capital but their Retirement Fee Analyzer is a great tool for this. They have a free tool that calculates how much you are paying in fees.

- Find additional 401(k) accounts. Many people think it’s only possible to get up to $18,500 into a 401(k) account. While it’s true that your contributions to 401(k) accounts are limited to $18,500, the annual deferred compensation limit is $55,000 per account. That means that if you have a generous employer, you can beat the $18,500 limit. One example of this is if your self-employment income where you are both the employee and the employer. You may be contributing $18,500 to your 401(k) at your day-job but nothing is stopping you from making additional contributions to a Solo 401(k) as an employer (although keep in mind that contribution amounts are limited by how much money you’re making with your self-employment income).

If you can follow these steps, you’ll be a 401(k) millionaire as well. The best news is that even if you don’t follow these steps you can still be well on your way to 401(k) millionaire status. For instance, the lawyer that works for 10 years and contributes the max to her 401(k) will end up with $267,566 (let’s assuming she worked from 30-years-old to 40-years-old). If she doesn’t contribute another dollar, she will likely still see a million dollars in her 401(k) account by 56-60 thanks to the compounding power of interest. So get started maxing out those accounts as early as you can and then let the money go to work for you.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Nice post. I’m a huge fan of the 401(k) as a cornerstone of retirement for most high-income professionals.

Did I read this correctly that you can continue to contribute to your 401(k) after early “retirement”? Are you assuming that some work will be done at a job that also gives access to a 401(k), or is there a way to continue to contribute to an account even once you’ve left your employer and maybe earning money elsewhere (such as Airbnb, etc.)?

As long as you have earned self-employment income you can contribute to a Solo 401(k). When you make those contributions you wear two hats, one as the employer and one as the employee. You can only contribute up to $18,500 across all of your 401(k) accounts as an employee but the calculation is different as an employer (up to $54,000). So yes, if you are early retired but have a side-hustle it’d be very easy to open up a Solo 401(k) and continue to make those contributions.

If I stopped working, I would certainly consider whether it made sense to continue contributing to a Roth Solo 401(k), as I’m not sure the traditional one would be worth it since you’d be paying so little tax on the income anyway. It’d be a good future post to explore! And, at the very least, it’s nice to have options.

I run a small law firm where I am the only equity partner. I am thinking of going with a profit sharing 401k plan where I contribute 3% to every employee regardless if they contribute or not. Doing this allows me to contribute to myself well beyond the typical $19,500 yearly max. Even better, the actuary said I do not need to give 3% to any non equity partners, but he couldn’t define what a non equity partner is per IRS. I said I pay one lawyer a base salary plus commission on work he brings in(3% for him is quite high). He said he thinks that is a non equity partner but I should make sure. After surfing the Internet for hours I came across your site. Do you have literature that can help me answer this question? I would be grateful for any advice and can speak privately. Thank you in advance