Many people fall victim to the trap of focusing on reducing taxes in April of each year as they prepare their tax returns. Unfortunately, they soon discover that by April it’s too late to implement anything. Your bill is simply due and you must pay.

The real opportunity to reduce next year’s tax payments comes in the steps that you can take this year and even though November is almost over, there are a few more things you can do. It’s what you do between now and December 31st that counts.

Here are eight ideas to help you jumpstart your tax savings planning.

- Max Out 401(k) Retirement Accounts

If you’ve been reading this site, you’re probably already maxing out your 401(k) account. For high-income lawyers, stuffing as much pre-tax money as possible into a 401(k) account is a great way to reduce your tax bill today. But what if you have been contributing but haven’t been maxing it out? Or what if you don’t have a 401(k)?

For 2018, the IRS set contribution limits for most investors at $18,500 (if you’re over 50, you may be able to make catch-up contributions of up to $6,000). If you haven’t fully maxed out your 401(k) already this year, you still have a few more weeks and paychecks to contribute as much as possible. Many employers will let you contribute up to 80-100% of your paycheck to a retirement account.

If you have savings in a cash account and would like to “contribute” it to a 401(k) (which can’t be done), by contributing 100% of your remaining paychecks to a 401(k) account and using the cash savings as living expenses, you’ll achieve the same result.

If 100% seems too aggressive, try contributing 50% of your paycheck while living off the cash savings.

If you feel that it’s too late to max out your 401(k) this year but would like to do so next year, don’t wait until January 2019 to get started. Use the rest of 2018 as a trial period for 2019. Determine how much you would need to contribute every month in order to max out your 401(k) in 2019, then adjust your current savings to meet that monthly rate (e.g. if you need to contribute 10% of your paycheck in order to max out your 401(k) in 2019, begin contributing 10% of your paycheck starting today). This will allow you to test out living on lower take-home pay for a short amount of time and ensure you’ll be able to hit the ground running – or rather, saving – in 2019.

2. Max Out Traditional IRA or Roth IRA Accounts

Similar to 401(k)s, you can also max out other retirement savings vehicles to help boost tax savings. Traditional and Roth IRAs are ways for workers to save either in addition to or in place of employer-sponsored plans.

Your income will dictate if you can use these vehicles and which contributions are taxable versus tax-free. In general, with a Roth IRA you pay taxes on the amount you contribute today, but you get to withdraw your savings tax-free in retirement. In contrast, with traditional IRAs you make contributions on a pre-tax basis, but you have to pay taxes on withdrawals in retirement.

For many lawyers at certain income levels set by the IRS you may not be able to contribute to a Roth IRA or make tax-free contributions to a traditional IRA. If this is the case, you can probably make a “backdoor Roth IRA” contribution. This will allow you to save an additional $5,500 in a tax-protected account this year. If you have a spouse, you can also make an additional $5,500 contribution in your spouse’s account regardless of whether that spouse has any earned income this year.

For more on income limits and how to perform the backdoor Roth IRA, check out my Backdoor Roth IRA Step by Step Guide.

3. Max Out Health Savings Account

You may think of your Health Savings Account (HSA) as just a way to use pre-tax money to pay for qualified medical expenses in the current year. HSAs are more powerful than that, however.

HSAs are triple-tax-advantaged, meaning the money isn’t taxed when contributed, as it grows or when it’s used (if used on qualified medical expenses). Even better, HSAs aren’t “use it or lose it” which means that you will always have access to your HSA and if you never use it for qualified medical expenses, you’ll be able to withdraw the money in retirement without penalty as if it were a traditional IRA.

These accounts have relatively low contribution limits, but if you have a high-deductible medical plan it probably makes sense to maximize your contributions each year. Many investors are treating these as Stealth IRAs.

4. Understand How Taxes are Impacting Your Decisions

If you’re already dominating your retirement accounts, the end of the year is a great time to think about how the tax code impacts other life decisions. For example, what are the state and local tax rates where you live? Is there anything you might consider doing that could reduce those?

This year I finally took my own advice and we moved out of NYC to the surrounding area. Not only did my commute dramatically improve (surprise!) but for seven months we haven’t been paying the 3.85% NYC income tax. We used that money to increase our standard of living in what I’ve been telling everyone is a “revenue neutral lifestyle upgrade”. It’s been nice to let the City of New York pay for our nicer apartment by moving outside of the City of New York.

Are there similar decisions you might be making in the near future?

5. Take Advantage of Tax-Loss Harvesting

The stock market goes up and the stock market goes down. All we seem to know for sure is that historically, over long stretches of time, the stock market goes up. When the market goes down, those of us in the accumulation phase of life are generally happy to buy stocks at a discount but there’s another tactic available to catch a tax break when the market takes a dive.

Each year you are allowed to deduce up to $3,000 in net investment losses on your tax return. In other words, if you lose money in the market, Uncle Sam is there to share in your pain. That $3,000 loss can be applied against $3,000 in income, thus eliminating the need to pay income taxes on the $3,000 that you earned.

But who wants to lose money, right?

If you have $10,000 invested in the market and stocks fall by 30%, your portfolio is now worth $7,000 and you’ve incurred $3,000 in paper losses. If you sell that investment and purchase a similar asset, you’ll lock in the $3,000 loss, which you can now use to offset $3,000 in income.

If the securities recover to their original position, you’ll now have a portfolio worth $10,000 and a capital gain of $3,000 (the gain from your purchase price of $7,000 to the value of $10,000). You’ll have to pay capital gains taxes on the $3,000 but those capital gain tax rates will probably be 15%. Meanwhile, you’ll have saved paying taxes at ordinary income tax rates.

Save paying taxes on $3,000 at ordinary income tax rates and later pay taxes on $3,000 at capital gains tax rates? That’s a trade I’d be willing to make every time. This is known as tax-loss harvesting.

6. 529 Contributions

For some reason, tuition for higher education in America keeps rising much faster than the rate of inflation. One way to help your offspring potentially avoid crippling student loans, while realizing some tax benefits for yourself, is to open a 529 account.

With a 529, you can contribute dollars (taxed by the federal government but not taxed by your state) into an account that grows tax-free and can be withdrawn tax-free if used for qualified education expenses. These plans are sponsored by states, although you don’t have to use your state’s plan.

529 plans don’t have the obvious benefits that you get from retirement accounts. For one, you’re only saving on the state and local income taxes. Live in Texas or another state with no income tax? The value of a 529 drops tremendously. Live in NYC where you’re paying both state and city tax? They start to look a little more appealing.

I would prioritize retirement account contributions first, but if you have additional money to save and either have children or are planning to have children, 529s are worth investigating.

7. Stay on Top of the Tax Code

I know that staying on top of the tax code and recent change in the Tax Cuts and Jobs Act of 2017 is probably not your idea of a good time. But we made it through civil procedure, right? With the last weeks of the year slipping away, take this opportunity to dive a little deeper into next year’s tax code. Patience and determination are your friend here.

Here’s a few of the highlights coming next year:

- The child tax credit doubled to $2,000 per child under 17

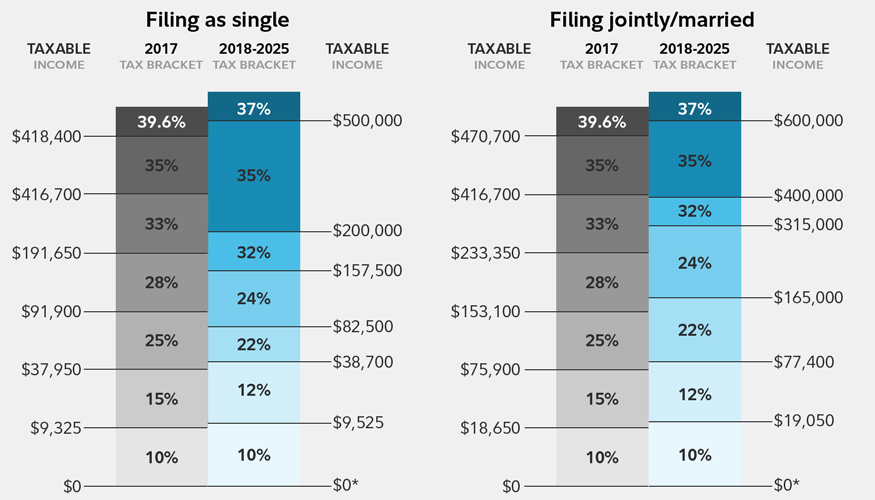

- There are incremental changes to the seven individual tax brackets as outlined below

8. Evaluate Business Expenses

If you run your own business (and really, everyone should), keep in most of your business expenses are deductible against your business income. Don’t get caught into the trap of thinking that running your own business means having a auto repair shop on the side.

With the gig economy in full stride, if you’re participating in most of those activities, you’re likely working as an independent contractor and receiving a Form 1099 at the end of the year. That means that you’re already running your own business, even if it’s just as a sole proprietor.

Businesses are allowed to deduct their expenses. You can reduce next year’s tax bill if you start to track you’re expenses this year. Now is a great time to begin paying attention if you hadn’t thought of this before. Even if you only made $1,000 last year driving Uber, shouldn’t you reduce the portion of that income that is taxable by as much as possible? Expenses like gas, repairs and your cell phone bill are likely deductible.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

One of the things I do is juggle my collections for my consulting work. I’m busiest in Q4 and depending on what else has happened that year and what I’m expecting for the following year, it may make sense to push on getting payments now or punting to the next year. Our income is calculated on a cash-in basis. I then take a look at expenses to determine if it’s better to take some in the current year (if income is running high) or punt to next year (if I suspect next year will be the bigger year, or if I already have a lot of expenses for this year).