The theme this month is Moving Forward because, what else can we do in January other than keep going? It’s the only way to make it through a Northeast winter and it’s the only way to get your finances in order. Just keep moving forward!

But in order to move forward, it’s good to have a grasp on the underlying facts and this year is bound to be a complicated one thanks to the recent changes in the tax law (the always optimistically named Tax Cuts and Jobs Act (TCJA)). While it will take months for us to fully absorb TCJA – and I have a specific post coming with my thoughts on how it impacts lawyers – there are simple contours of the new law that are worth knowing up front.

The main point to keep in mind is not that much actually changed. We still have seven tax brackets, retirement accounts, incentives for having kids and methods for reducing our taxable income. There will be more loopholes and ways to take advantage for the tax code but nothing that makes it obvious that you should start or stop doing anything you’re already doing (saving as much as you can, reducing taxes where possible and making your money work as hard as you do).

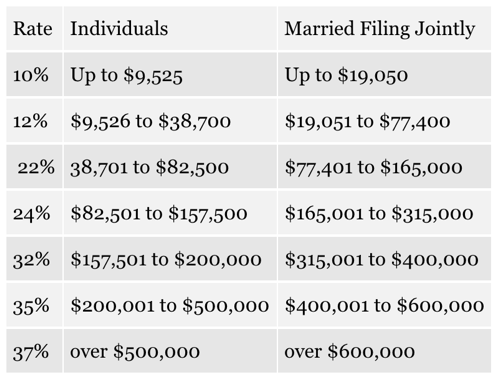

Here’s a look at the tax brackets for 2018. Keep in mind that the new tax brackets are only supposed to last until 2025. I didn’t note those expiration dates below as seven years is a long time and it’s hard to predict what will happen. The last time this happened, during the Bush 2003 tax cuts, they were made permanent in 2013 under the Obama administration, so your guess is as good as anyone else’s whether these tax changes will be permanent. It’s all kind of silly to think of any tax changes as permanent.

2018 tax brackets

2018 retirement account contribution limits

While you can do a little planning knowing the tax brackets, don’t forget that in some cases the retirement account contributions have increased in 2018. As such, you may need to make a few adjustments to continue maxing them out this year (although we generally try to max them out early in the year).

- 401(k), 457(b) and 403(a) Contribution Limits are bumped up an extra $500 this year to $18,500. The limit applies to both Roth and Pre-Tax Contributions. If you are over 50, you’re eligible for the “catch-up” contribution which is $6,000 per year for a total contribution limit of $24,500. For us the $500 bump results in an extra $1,500 we can save pre-tax.

- Roth IRA Contribution Limits remain at $5,500 ($11,000 for couples), with no increase for 2018. That’s a bummer but in good news the Backdoor Roth IRA survived TCJA (probably because it increases government revenue, so they’re likely to leave it alone). Remember that you need $5,500 of earned income to make an IRA contribution but that you can contribute on behalf of a non-working spouse, so if one of you is working and the other is not, it shouldn’t be hard to contribute $11,000 for the year. If you’re over age 50, you can contribute another $1,000 to an IRA.

- Health Savings Account Contribution Limits are bumped up an extra $50 to $3,450 for singles and an extra $150 for families up to $6,900. If you’re 55 or older, you can add an extra $1,000 to those contribution limits. HSAs remain a great way to stash money for retirement and still remain my favorite way to take advantage of triple-tax savings.

Standard deduction vs itemizing deductions

The big elephant in the room is whether you’ll take the standard deduction in 2018 or itemize your deductions. If you take the standard deduction, you’ll lose the ability to take all the other itemized deductions listed on Schedule A. Early reports suggest that the TCJA changes to the code will make it such that only about 10% of filers decide to itemize their deductions going forward. I suspect that will impact a lot of lawyers.

While the deduction for state and local property taxes and income taxes remains in place, as well as the option to deduct state and local sales taxes instead of income taxes, the total deduction available is limited to $10,000 per year (for single or married filers). Meanwhile, the standard deduction is $12,000 for single filers and $24,000 for married filers. That means that even if you max out the $10,000 in state and local property, income or sales taxes, you’ll need another $2,000 of itemized deductions (single filers) or $12,000 of itemized deductions (married filers) to be in a position where you’d want to itemize your deductions on Schedule A.

This will likely mean that we’ll be taking the standard deduction in 2018 (although I’ll link to my final analysis when it’s done). If so, the biggest impact will be on our charitable giving. Charitable deductions are a below-the-line deduction, which means they show up on Schedule A. If you take the standard deduction, charitable deductions do not reduce your taxable income.

While I’d like to think our charitable giving won’t be impacted, I firmly believe that the tax code is the government’s method for making public policy decisions and without the incentive to donate, people will naturally be less motivated. I used to seek out ways to donate to charity (my firm is getting rid of old computers? I’ll be happy to take those off your hands for you …) but will be less motivated to find those opportunities now. We also pay people to take bags of donations to local charities since we don’t own a car. It’s harder to justify doing that without getting the deduction! But who knows, maybe our charitable giving will stay the same this year. I’ll let you know!

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.

Because of the SALT caps, we’re ~3-4k short of the standard deduction based on our mortgage+local taxes. Which, if we decide to go the tax optimal route, probably means we’ll be bunching our planned charitable giving for every other year.

Bummer. Bunching your planned charitable giving is a good idea. I wish we didn’t have to resort to bunching though.

My charitable giving is dropping to $0.

That’s what I’m expecting as well, except for a couple of inevitable donations to people’s charity runs or something similar.

Why would your charitable contributions drop to $0 instead of being reduced to account for the inability to deduct?

For me, most of my charitable contributions during this phase of life are donations of used household items and clothing. Because these cost real money to make it from my home to the place where they are donated, the incentives are now such that it’s a net negative to donate items rather than a net positive (using the terms “negative” and “positive” strictly with respect to cash).

You only donate used goods? And you will cut that modest amount of charity out because you won’t be reimbursed? That’s cold. Regardless, donating used goods that can be used by someone else and kept out of the landfill takes very little real money or effort. There are donation bins from one organization or another just about everywhere a few feet from the road.

I’m hoping the impact of the TCJA on charitable giving is a wash because smaller donors taking the standard deduction won’t be inflating their numbers/charitable activities to reduce their tax burden, and large cash donors will still be itemizing or be paying less in taxes in general than before.

The tax code is public policy. It shifts behaviors. Do what it wants you to do and you will be rewarded (like when you contribute to a retirement account). Do what it doesn’t want you to do and you will be taxed (like when you donate to a charity while taking the standard deduction).