When you’re signing up for a high-deductible insurance plan, you may see an unfamiliar option to open a Health Savings Account. One of the newest savings accounts created by Congress, you’d be excused for not understanding how a Health Savings Account can fit into your overall financial strategy. Read on for the basics of a Health Savings Account and how you can turn it into a Stealth IRA if you want to supercharge your retirement savings.

Qualifying for a health savings account

If you’ve enrolled in a high-deductible health plan, you qualify for an HSA. The HSA is meant to compliment the high-deductible insurance plan. By accepting the higher deductible, the government wants you to put aside money in a tax-free account to cover health expenses. There are no income restrictions on contributing to an HSA, which makes it ideal for lawyers.

How a health savings account works

If you have a high-deductible health plan at work, HSAs are a no-brainer. Unlike a Flexible Savings Account where you must use the funds each year or risk forfeiture, you own the money deposited into an HSA and do not need to spend it each calendar year. If you end your HSA-eligible insurance coverage (e.g. because you switch to a non-HDHP plan), you lose the ability to contribute additional money to your HSA but you keep the funds already in the HSA.

The funds in your Health Savings Account can be used for a qualified medical expense. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction on Schedule A of Form 1040. These expenses are described in detail in Publication 502, Medical and Dental Expenses, but generally include expenses not reimbursed by your medical insurance provider, such as co-pays, laboratory fees, prescription drugs, vision care and deductibles.

Over-the-counter drugs are not included. In general, I’m not too concerned about what does and does not qualify as medical expenses, as I expect to either use my HSA later in life when I experience real medical problems or will withdraw it after the age of 65 when I can do so without penalty (more on that below).

The triple tax-advantages of a health savings account

A triple tax-advantaged account is the holy grail in savings. Your money is not taxed going into, while growing, or, if used for medical expenses, when coming out of an HSA.

Let’s break it down:

- The money contributed to an HSA is not subject to federal income tax at the time of deposit;

- The returns from investments inside the HSA are not subject to federal income tax as your account grows; and

- Withdrawals are not subject to federal income tax if used for qualified medical expenses. Further, HSA funds roll over and accumulate year to year if not spent, so there’s no chance of losing your funds at the end of the year as is the case with Flexible Spending Accounts (FSAs).

If you don’t use your HSA for qualified medical expenses, it can be withdrawn without penalty at any time after you reach 65. At age 65, it’s treated like a Traditional IRA, so you’ll only pay income taxes (and this is the key benefit of the Health Savings Account).

Using your health savings account as a Stealth IRA

We’ve already established that you can use your Health Savings Account to pay for qualified medical expenses. But if you end up never having any qualified medical expenses, you can withdraw from the Health Savings Account after age 65 as if it were a Traditional IRA.

I’m treating my HSA as a retirement account, therefore I have no plans to withdraw the funds. I max out the account every year and am investing the money in the stock market using index funds. My hope is that it will compound and grow without being touched until I’m 65.

If I have an expensive medical problem between then and now, I will use the HSA funds to pay for the medical expenses. In many ways, this gives me comfort that I have money saved up should the health care system fail me.

If I reach 65 without touching the HSA funds, I will use them as part of my asset strategy at that time. That likely means I will either: (1) continue to hold the funds and use them for qualified medical expenses, thus never paying taxes on the money; (2) withdraw the funds and pay low income taxes or (3) withdraw the funds using receipts for medical expenses incurred over the previous 30 years (as discussed below).

Other factors to consider for health savings accounts

What types of investments can I make with HSA funds?

An HSA can be invested in the same way as a 401(k) or an IRA, depending on the options offered by your HSA provider.

One popular HSA provider offers a range of low-cost index funds, including funds that I invest in like the Vanguard S&P 500 and Vanguard Total International Stock Fund. With expense ratios of 0.17% and 0.19% respectively, those numbers are hard to beat.

One downside is that your HSA provider may charge you an account maintenance fee. My HSA provider charges $3.50 a month regardless of the balance. At $42 a year, it’s a hefty amount for a small $1,000 balance, but since the fee is fixed it becomes less of an issue as your account balance grows. My provider requires me to maintain $1,000 in cash, which is a little frustrating since it limits the amount you can invest in the market.

Can I switch HSA providers?

Many people don’t realize that you’re not required to use the HSA provider selected by your employer, unlike 401(k)s. You can use any provider you like.

Don’t like the investment options available to you? Unhappy with the amount of fees? There is a growing market of investment firms offering better HSA options. This is something I’d like to look into myself.

If you choose to use a separate HSA provider, make sure your employer sends the check directly to the HSA provider so that you can save on payroll taxes. Like pre-tax insurance premiums, HSA contributions are not subject to Social Security and Medicare taxes as long as the plan is classified as a Section 125 plan.

Withdrawal strategies for HSA accounts

HSA participants do not have to obtain advance approval from their HSA trustee or medical insurance company to withdraw funds. Depending on your HSA trustee, you can withdraw funds using a debit card, writing a check against the account or by following a reimbursement process.

Funds can be withdrawn for any reason, but withdrawals that are not for qualified medical expenses are subject to income taxes and a 20% penalty. Account holders are required to retain documentation of the qualified medical expenses. In an audit it will be your burden to prove to the IRS that your withdrawals were for qualified medical expenses.

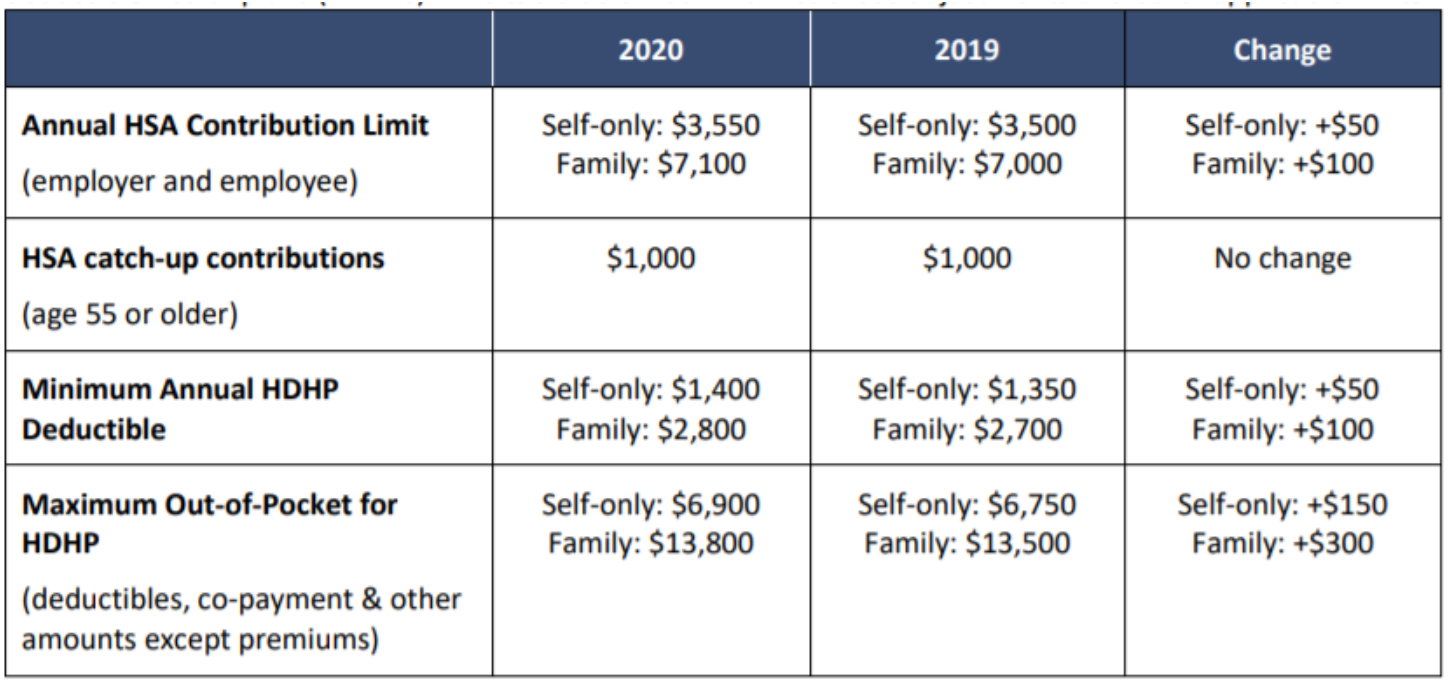

Health savings account contribution limits

State tax treatment

State tax treatment of HSAs varies. As of 2019, two states (California and New Jersey) do not recognize HSAs and do not allow deductions of HSA contributions for state income tax purposes. In NYC, contributions to an HSA will be free of federal, state and local income taxes (triple win!).

HSA accounts at death

When an HSA account holder dies, the funds in their HSA are transferred to the beneficiary named on the account. If the beneficiary is a spouse, the transfer is tax-free. If the beneficiary is not a spouse, the account is no longer an HSA and it becomes taxable to the beneficiary in the year the HSA owner dies (But the amount taxable to the beneficiary is reduced by any qualified medical expenses for the decedent that are paid by the beneficiary within 1 year after the date of death). See IRS Publication 969.

This is a generally favorable treatment of the HSA funds, in that you can transfer them to your spouse tax-free. However, given that the account is taxable to a non-spouse beneficiary, it seems to make sense to expect to use up the HSA during your lifetime.

Three ways to manage your HSA

Having covered the basics, there are really three different ways to treat your health savings account:

Use the health savings account as a stealth IRA

As described above, I’m choosing to use my Health Savings Account as a Stealth IRA for now. That means I’m maxing out contributions every year and not withdrawing funds to pay for qualified medical expenses. I’m hoping the money will compound inside the account and continue to grow tax-free such that I’ll be able to use it for medical expenses later in life or, if I remain healthy, as a Traditional IRA once I reach age 65.

Pay for current out-of-pocket medical expenses

If I haven’t convinced you that the HSA is a Stealth IRA and should be used in retirement, you can always use the HSA to pay for current out-of-pocket medical expenses.

Thanks to the fairly generous definition of qualified medical expenses, there are plenty of opportunities to use the funds to pay for current expenses. Since the process of reimbursement is simple, I certainly take no issue with someone wanting to reimburse themselves in real time from their HSA as expenses are incurred.

The goal is reduce the drag of taxes on your retirement and savings, so I’m all far any smart strategy for using the system as it has been designed. It only takes a little bit of tax planning to reap significant rewards. Using HSA funds to pay for current medical expenses is a great approach.

Save receipts for future reimbursement

When Congress set up the HSA they made it clear that at your own election you can reimburse yourself for qualified medical expenses. They didn’t say when you have to make the reimbursement.

In other words, you can incur the qualified medical expense today but apply for reimbursement later – much later. Perhaps even 45 years later. The benefit of course is that your money is compounding tax free during the interim and you can then withdraw it in retirement without having to pay expenses.

Sound too cute and clever to be true? It’s not. See Question 39 to IRS Bulletin 2004-33 Notice 2004-50:

An account beneficiary may defer to later taxable years distributions from HSAs to pay or reimburse qualified medical expenses incurred in the current year as long as the expenses were incurred after the HSA was established. Similarly, a distribution from an HSA in the current year can be used to pay or reimburse expenses incurred in any prior year as long as the expenses were incurred after the HSA was established. Thus, there is no time limit on when the distribution must occur. However, to be excludable from the account beneficiary’s gross income, he or she must keep records sufficient to later show that the distributions were exclusively to pay or reimburse qualified medical expenses, that the qualified medical expenses have not been previously paid or reimbursed from another source and that the medical expenses have not been taken as an itemized deduction in any prior taxable year

Keeping track of my receipts for 35 years seems overly complicated to me and doesn’t fit within my investment policy statement of keeping investments simple.

However, I may keep track of medical receipts anyway as part of my own system of using automated computer slaves to organize my information. While I’m not going out of my way to capture qualified medical expenses, the information is certainly being retained and I expect to have the ability to search the information in the future – or maybe Siri will do it for me.

If I have access to these receipts, I would have no problem spending a few hours rounding them up and making a large withdrawal based on those receipts. This will even be easier since I plan on making no previous withdrawals, thus eliminating any risk that I might double count a qualified medical expense.

If one day I’m faced with the problem of whether I have access to medical receipts to justify taking the money out tax free or whether I need to pay income taxes on the amounts withdrawn – Well, we should all be so lucky.

Is it worth switching to an HDHP to have access to an HSA?

Only you can answer this question by examining your own medical expenses. For many young lawyers with little or no medical expenses, switching to an HDHP and investing in an HSA is going to make a lot of sense.

To make the calculation, add up the premium savings by switching to an HDHP. Subtract the additional costs incurred by paying a higher deductible based on your expected annual medical expenses. If the number is negative, that’s the cost of having access to an HSA. If the number if positive, you should feel pretty comfortable about making the switch.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.