Part of every good investment plan is making sure you’re covered in situation involving disability or death. After publishing an intro to disability insurance (and more specifically, why you need disability insurance), it came to my attention that most, if not all, of us are eligible for Social Security benefits.

Many of the millennial generation have written off Social Security. It’s not uncommon to leave Social Security out of any retirement or insurance plan. This strikes me as shortsighted. While it’s hard to gauge how much you can expect to receive in benefits in 30 years, Social Security is a wildly popular program that seems very like to continue to exist when you reach retirement.

Plus, as we’ll see in a few paragraphs, there are certain benefits which you may be eligible to receive now, such as disability and survivor benefits.

There are three main components to Social Security benefits: retirement, disability and survivor.

Setting up your social security account

First, if you haven’t already, now would be a good time to set up your account with the Social Security Administration.

You want to set up this account as soon as possible to prevent the possibility of identity theft where someone else creates an account using your social security number and fraudulently applies for benefits on your behalf.

To create an account, go to https://secure.ssa.gov/RIL/SiView.do and click on “Create An Account”.

The Social Security Administration will send you a written letter with a unique code that allow you to set up two-factor authentication. Once you receive that letter, set up two-factor authentication (that’s where you use your password and a text message received by your cell phone to log in).

Once your account is set up, the first thing to check is your Earnings Record to make sure it’s accurate. You’ve probably been receiving these letters annually from the Social Security administration but, if not, check and make sure the information looks accurate.

Each year will show your Taxed Social Security Earnings (currently capped a $118,500) and your uncapped Taxed Medicare Earnings.

At the bottom there’s also an interesting box that tells you your estimated total taxes paid (both employee and employer) for Social Security and Medicare. Some people consider Social Security less as a tax and more as a forced retirement plan, so I find it interesting to see how much I’ve contributed (over $100K to Social Security).

In order to qualify for Social Security benefits, you must accumulate at least 40 credits in the Social Security system. In 2017, you receive one credit for each $1,300 of earnings, up to the maximum of four credits per year. Therefore, you’re probably earning 4 credits per year, which means you need 10 years of working to fully qualify for all Social Security benefits (keep in mind that your earnings from summer / school jobs count as well).

There are special circumstances where you can qualify for disability and survivor benefits with less than 40 credits (which makes sense, otherwise these benefits would leave a gap in coverage). See the full explanation from the Social Security Administration in Publication EN-05-10072.

Example. Larry started his first job ever at a law firm at the age of 26. He becomes disabled at the age of 32 after working for six years and earning 24 credits. According to SSA Publication EN-05-10072, Larry should generally be eligible for disability benefits.

Social security benefits

Retirement benefits

Once your account is set up and you’ve verified that your earnings record is accurate, there are three main benefits to explore.

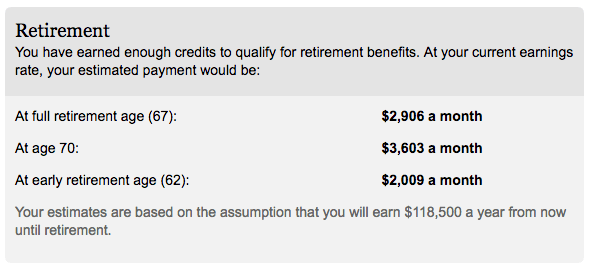

Your Social Security retirement benefits aren’t going to be that helpful, but it’s worth taking a look. Here’s what mine looks like.

As you can see from the above, the Social Security Administration assumes that you’ll earn a certain amount each year from now until retirement. I suppose this is as good of a way to do it as any other way but for those of you thinking of financial independence, you might not be working up until you turn 62.

Still, at least you now have a rough guide as to what retirement benefits you might expect to receive. I don’t include any of these numbers in my own retirement planning (for now) since the benefits are too far into the future to accurately calculate. But I still think that I will receive them at some point (much like my pension that kicks in when I turn 65).

Between Social Security retirement benefits and the pension, hopefully I’ll be at the point that in a worst case scenario I won’t be stuck living in a cardboard box at the age of 65.

If you’re considering early retirement, here’s a calculator from the SSA page that can help you calculate your benefits assuming that you aren’t going to work up until age 67.

Disability benefits

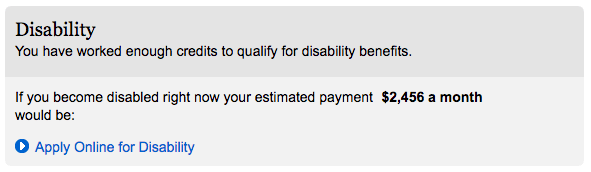

Perhaps more relevant to today’s planning, the Social Security Administration also provides you with a calculation of the monthly payment you could expect to receive should you become disabled right now. Here’s what mine looks like.

It’s beyond the scope of this article to discuss what it means to be “disabled” under Social Security Administration standards, but if you’re looking to understand that better, here’s the link to the SSA’s Disability Evaluation.

Suffice to say that being disabled is 50 shades of gray as opposed to the black and white of whether you’re dead or alive, which is why the definition of disability is so important in your group or individual disability insurance.

Knowing that if I became disabled that I would be entitled to receive $2,456 a month is worth tracking. I’ve included that information in my Investment Policy Statement. While not an “investment”, my IPS also includes a handy cheat sheet with insurance coverage so I can see at a glance how I’m protected (health, disability, life, renter’s, liability, etc.). Social Security Disability Insurance is simply one more piece of the foundation should I ever need to use it.

Survivor benefits

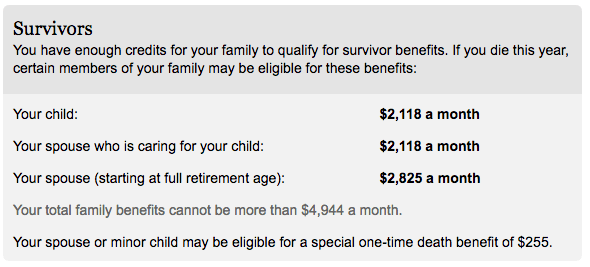

The third and final benefit to track is the survivor benefit should you die this year. It covers three scenarios: (1) benefits for your child; (2) benefits for a spouse caring for a child and (3) benefits for your spouse as full retirement age. Here’s what mine looks like.

I keep track of the survivor benefits in the life insurance section of my Investment Policy Statement since these payments would act like a payment during an early death.

Note that the total family benefits is capped at $4,944, which would apply if I had multiple children (I don’t).

$4,944 for my wife and kids is a huge amount of money ($59,328 a year) which could quite possibly cover annual expenditures for a family of 3.

The survivors benefits only extend to age 18 (up to age 19 if attending elementary or secondary school full time). That seems reasonable to me. So it’s not a total replacement for life insurance (which would protect your spouse going forward) but it’s a nice benefit to include in your calculations of how much life insurance you need.

Medicare

It’s also worth mentioning that your account will let you know if you’ve worked enough to qualify for Medicare, which currently kicks in at age 65. It’s good to know that you only have to solve for the health insurance problem from now until 65.

The new new deal

I’m optimistic that the federal government will figure out a way to keep the Social Security program solvent going forward. I didn’t pay attention to survivor benefits or disability benefits until I started to think about having a family and whether or not I needed disability insurance outside of my group plan. It’s good to include these numbers in your own calculation.

If you haven’t already created an account, go to https://secure.ssa.gov/RIL/SiView.do, sign up and check out your specific benefits.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He convinces the student loan refinancing companies to give you cashback bonuses for refinancing your student loans and looks forward to you discovering how easy it is to track your net worth with a free tool like Empower.