Once a retirement account is opened, many people have a difficult time deciding between the Roth or Traditional contributions. Roth contributions are made with after-tax dollars. The money grows tax free and then you never have to pay taxes on the money again. All qualified withdrawals are tax-free. That sounds like a pretty good deal and there’s minimal uncertainty since you know each dollar in your retirement account represents a real dollar that you’ll be able to withdraw.

On the other hand, Traditional contributions are made with pre-tax dollars. The money grows tax free but you’ll have to pay income taxes at the time of withdrawal. The advantage of this approach is that you save the money immediately by reducing your current tax burden, which can be significant during your working years when you are paying a high marginal tax rate.

So which is better?

The Finance Buff makes a pretty convincing argument against Roth 401(k)s. The Boglehead Wiki takes a more nuanced approach. What makes sense for high earning lawyers?

The only firm rule is that you should make Roth contributions when your income is low and Traditional contributions when your income is high. This means that law students should take advantage of low earning years to contribute as much as they can to after-tax accounts like the Roth IRA and Roth 401(k). Those making a high amount should be doing everything they can to reduce their taxable income.

Let’s run the numbers

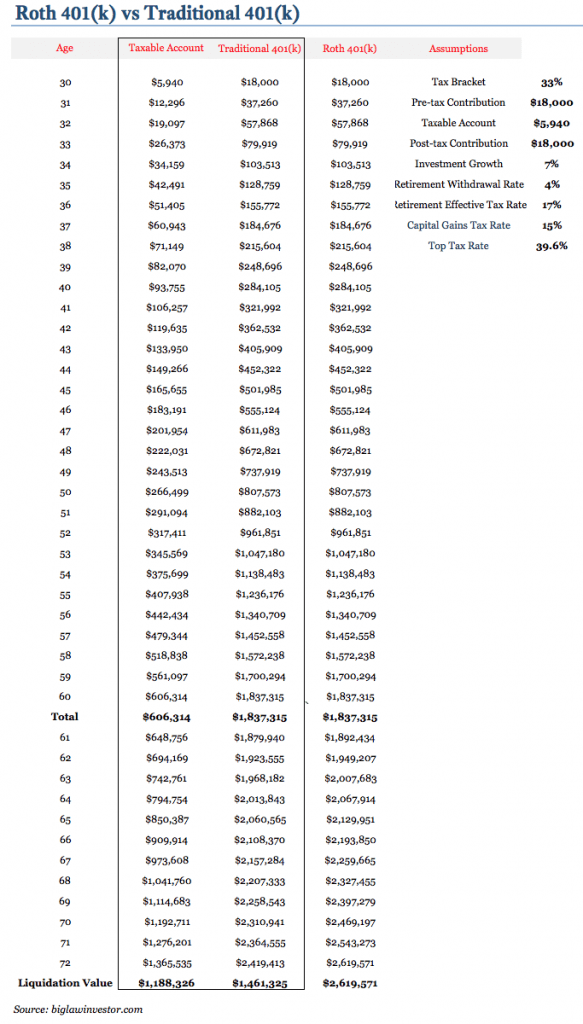

I’ve created the below table to look at how much money you’d accumulate if you max out your 401(k) for 30 working years. The key assumption here is that if you make a Traditional 401(k) contribution, you use the annual tax savings to make a corresponding contribution to a taxable account. This is because since the Roth 401(k) represents post-tax money, you’re able to save “more” money in the Roth 401(k) by contributing the maximum $18,000 than you save when you contribute $18,000 pre-tax money to the Traditional 401(k).

As you can see, at age 60 you’ll end up with the same dollar amount in both the Traditional 401(k) and the Roth 401(k). This intuitively makes sense. If you’ve gone the Traditional 401(k) route, you’ll also end up with a taxable account containing $606,314 for a total of $2,443,629. While this is substantially more than the Roth 401(k) balance, keep in mind that you’ll need to pay income taxes on that money upon withdrawal.

From ages 61-72 I assumed you wanted to withdraw 4% of your portfolio for living expenses. I assumed you would withdraw the 4% from the 401(k) account in both circumstances, leaving the taxable account to continue to grow. As you can see, both 401(k) accounts continue to increase in value since the 4% withdrawal rate is not high enough to eat into the 7% returns. The only difference is that you need to withdraw more money from the Traditional 401(k) to pay your taxes, which is why it lags behind the Roth 401(k).

At age 72, I decided to liquidate the accounts so we could compare apples to apples. That assumes you pay a 15% capital gain tax on the appreciation in the Taxable Account and that you pay a hefty 39.6% tax on the Traditional 401(k) account. Keep in mind that you’d never do this, but even if you did you’d have slightly more money had you gone the Traditional 401(k) route ($2,649,651 vs $2,619,571).

Other considerations

- Tax Diversification. As discussed previously, tax diversification in retirement is useful because you can pull income from both tax-deferred sources (Traditional 401(k) and Traditional IRA) and tax-free (Roth). It’s ideal to have access to both types of dollars in retirement so that you can minimize taxes. By selectively withdrawing from both sources, it’s possible that you could effectively have zero taxes in retirement.

- Other Retirement Income. If you anticipate that you’re going to have other taxable income in retirement, the scales will lean towards increasing your Roth balance. For example, most professionals will have to pay taxes on Social Security income, but the increased income in retirement could come from other sources, like rental income from an investment property, pensions or a working spouse. The more income you have in retirement, the higher rate at which your Traditional 401(k) will be taxed.

- Larger Roth 401(k) Contributions. As mentioned at the beginning of this article, since Roth 401(k) contributions are made with after-tax dollars, you can effectively put more money in a Roth account than you can in a Traditional account. Contributing $18,000 in a Traditional 401(k) when you have a marginal tax rate of 33% is equivalent to making a $12,060 contribution to a Roth 401(k). If you make the maximum contribution to a Roth 401(k), that’s an $18,000 contribution. If you are worried that you don’t have the discipline to establish the Taxable Account used in the above numbers (or otherwise use the money towards investments / avoiding debt), the Roth 401(k) may be more appealing to you.

- State and Local Taxes. So far this article has only focused on federal taxes, but state and local taxes also figure into your consideration. If you’re working in New York and paying a combined 10% to New York State and NYC but plan on retiring in Florida where there is no state income tax, your incentive is to avoid paying taxes today and defer them until you live in a state with no income tax. Conversely, if you are working in Florida but plan on retiring to New York, you may want to pay the taxes up front.

- Tax Risk. Because tax rates may shift in the future, there is some tax risk in choosing the Traditional 401(k) route. Taxes in the future could be considerably higher than they are today. I don’t think much faith should be put in this argument though. There’s also a risk that Roth 401(k) accounts may be taxed in the future despite the promise that withdrawals with be tax-free. It’s also impossible to know for sure what future tax rates will be. They could be lower than they are today. Given current strategies involving the use of pre-tax and tax-free money in retirement, it’s possible to considerably lower your taxable income in retirement, so even future increases in tax rates may not impact you. Finally, if you have a Traditional 401(k) you may also have opportunities in the future to convert the money into Roth accounts at a low or zero tax rate (e.g. if you have a year of no income, you can convert a considerable amount of money from a Traditional to a Roth account and pay zero income taxes along the way).

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He knows that the Bogleheads forum is a great resource for tax questions and is always looking for honest advisors that provide good advice for a fair price.