Earlier this week I shared with you our portfolio performance for 2017. We’re happy with the return but also curious if we’re adhering to our target allocation, especially now that we’re married and have combined two portfolios.

While your asset allocation isn’t too important during the early stages of your career, it’s something to consider after you’ve assembled a decent amount of cash and it’s something to work on when you’re merging two people’s finances.

As a reminder, we intend to follow the lazy 3-fund portfolio from the Bogleheads community, consisting of the following allocation:

- 70% – US Stocks

- 20% – International Stocks

- 10% – Bonds

I came up with this allocation after writing my Investment Policy Statement and determining what felt like a reasonable split between the various asset classes. This simple portfolio allowed me to focus on saving money and not fiddling with my asset allocation when “good enough” is good enough. Is it the best portfolio in the world? Probably not, but only hindsight can answer that question. This allocation works for us because it is easy to follow, captures the market returns and doesn’t require much fussing.

Now that you know our target allocation, how close did we get?

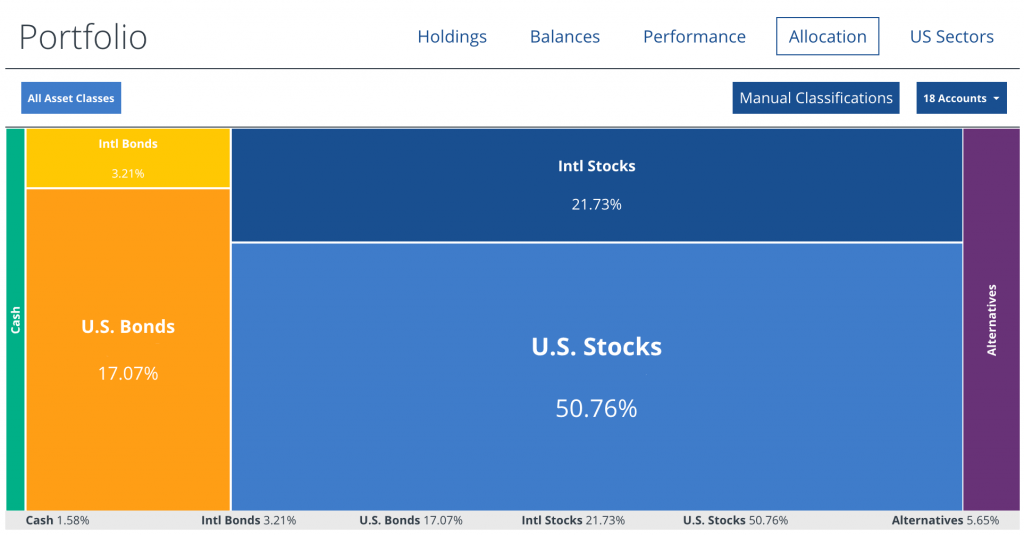

Ouch. This seems a little out-of-whack with our intentions. Here’s how our actual portfolio breaks down:

- 51% – US Stocks

- 22% – International Stocks

- 20% – Bonds

- 6% – Alternatives

- 2% – Cash

Unfortunately, I don’t have a graphic of the portfolio at the end of 2017. It was much worse then. The portfolio percentage you see above reflects the asset allocation as of mid-February after I had already initiated some course correction.

Here are some questions I’d have if I were reading this article instead of writing it:

Q: Why are US Stocks so low when you intend to have 70% of your portfolio in this category?

US Stocks used to be 70% of my portfolio, but then I got engaged, and we started taking advantage of my wife’s 403(b) account which pays a fixed 8.25% return. She also has mandatory contributions to a pension, both of which we treat as bonds in our portfolio since we expect to eventually roll the money into an IRA (although I’ll keep the funds in the 8.25% account as long as they will let me).

Q: Why are bonds so high? That’s double the amount of bonds that you want in your portfolio.

The bonds represent the wife’s 403(b) and pension, along with the bond portion of VSCGX and miscellaneous other bond positions that have crept into the portfolio. My wife’s 403(b) has an 8.25% return, and the pension has a 5% return, so the reasonable solution would be to reduce our exposure to bond mutual funds wherever we can.

Q: What are alternative investments?

Alternative investments include the money in PeerStreet and real estate investments from VTSAX and other mutual funds (all of which contain a small portion of real estate investments through stakes in publicly traded REITs).

Q: Is it possible to reduce your cash position down to 0%?

Unfortunately, no. Cash is a minimal part of our portfolio, but the various index funds typically have a small cash position. Our cash position doesn’t represent any cash that we’re holding in a retirement account. It’s just the sliver of the index funds that are in cash.

Resetting the allocation

Once we combined portfolios and started taking advantage of the 403(b), I knew the problem of being “bond heavy” would materialize at some point. So what can we do to right the ship and take on more equity risk?

Reduce Bond Mutual Fund Exposure. The first obvious step is to reduce our exposure to bond mutual funds. I’m quite comfortable letting the 403(b) and the pension funds make up our 10% of bond exposure. Using Personal Capital, I can tell that my bond exposure is mainly thanks to two funds: VSCGX and VFIFX.

VSCGX is the Vanguard LifeStrategy Conservative Growth Fund and is made up of a 40/60 equity and bond split. The 60% of the fund devoted to bonds used to form a part of the 10% overall portfolio allocation toward bonds. Now it’s just causing problems. Unfortunately, it’s in a taxable account and so selling it would incur capital gains taxes. I’m not willing to do that, so there’s not much that can be done here other than committing to stopping all further investments into this fund (which has been the case for over five years now).

VFIFX is the Vanguard Target Retirement 2050 Fund and is in my wife’s Roth IRA account. It represents a tiny fraction of our portfolio but is a mix of 90/10 stocks and bonds. As such, it’s an excellent candidate to be converted entirely into US Stocks because (1) it’s in a Roth account, so we don’t have to worry about taxes and (2) because, in addition to slightly reducing our bond exposure, it will also reduce our international stock exposure since it contains a 54/36 mix of US and foreign stocks. Result: Convert 100% of the holdings into VTSAX.

Eagle-eyed readers may have also noticed FXSTX in our portfolio. FXSTX is the Fidelity U.S. Bond Index Fund and is in my 401(k). It is a holdover from when I had a stronger bond position inside my 401(k). It’s an easy candidate to convert into VITSX. Unfortunately, it’s a minuscule amount as well.

Buy More US Stock. The other way to increase our US stock position is to buy more US stocks! And that’s precisely what we’ve been doing since the beginning of 2018, which is why the portfolio as presented to you is closer to our target allocation than it was at the beginning of the year. All new contributions (in the 401(k), 457(b) and taxable accounts) are going directly into US stocks. The only exception to the rule is the retirement contributions to the 403(b) and the pension. Thankfully, we’re making more contributions to the other accounts than we are to the 403(b) and the pension, so the situation should right itself over time. I’ll be keeping a close eye on this allocation over the next six months.

Rethinking the overall asset allocation

Finally, the exercise has made it apparent that we probably can’t follow the simple 3-fund portfolio for much longer as I’d like to increase our exposure to real estate. PhysicianOnFIRE adheres to a 60/22.5/7.5/10 mix of US stock/International stock/REITs/Bonds. That’s closer to where I’m hoping to be by the end of 2018, although we don’t intend on investing in REITs and will shoot for a 60/20/10/10 split. That means it’s time to dust off the Investment Policy Statement and make an update.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I think buying bonds now is a poor long term investment. Interest rates are extremely low and are on the rise (long term).

I tend to agree, as does Warren Buffett. We’re lucky that we can make up our bond component with an attractive retirement account option.