The salary of a Biglaw associate starts at $225,000 according to the latest Biglaw salary scale and the average lawyer salary is $0. For the average law student with 1-2 years of post-college work experience, this is a staggering amount of money. It’s probably four or five times as much as they’ve made in any previous job.

It’s tempting to grow into the salary all at once. You’ve been working hard and delaying a lot of gratification to get to this point. You might think it’s time to live it up a little. The problem is humans are remarkably adaptive to their environment.

Pop Quiz: What’s your preference between winning the lottery and becoming paraplegic?

I’m going to guess you said winning the lottery. Turns out people have studied happiness levels for both groups and, according to Harvard psychologist Dan Gilbert, both groups are equally as happy after one year.

It turns out, humans have a really difficult time understanding the magnitude of a future benefit or a future loss.

The same types of studies have been applied to income levels. How much income does it take to achieve maximum happiness?

Economic Nobel Prize winner Angus Deaton thinks $75,000 is the magic number, with some minor variations for the coasts ($85-$90K for NY and CA). Earning above $75,000 doesn’t bring additional happiness. Instead, we adapt to the new quite quickly.

If you’re still a little skeptical, go talk to a fifth-year associate. That fifth-year associate is now earning $365,000, compared to the first-year associate making $225,000. Calculate the difference in salary and ask yourself, is the fifth-year associate that much happier than they were four years ago? Probably not. Like everyone else, they’ve adjusted to the increase in salary. This despite the fact their salary has increased more than the median salary for US households.

How to beat the odds

If you believe: (i) humans are adaptive, (ii) $75,000 is a reasonable salary and (ii) earning an extra $80,000 by itself will not make you any happier, there’s a simple solution. Limit your salary but not your earnings.

By choosing to grow slowly into your salary, you will amass a huge war chest of savings (or pay off your loans), keep yourself off the Hedonic Treadmill and eliminate the risk of misusing such a high salary.

How to set your salary

Phone bill about $2Gs flat. No need to worry my accountant handles that. – Notorious B.I.G.

Of course I’m not proposing that you give the bulk of your salary to charity. I’m suggesting that you set up a simple system to automatically handle your finances and that you give yourself a fixed salary each month which is substantially lower than your actual salary.

By setting up a system where it’s difficult to withdraw money, you’ll give yourself two benefits: (1) money we don’t see is less likely to be spent and (2) any hurdle to accessing your money is an effective barrier to keep you from raiding it during stressful career moments.

Picking The Number. So, how much money do you need to live on when you’re fresh out of law school? Can you live on $60,000 a year? $80,000? Take a few moments to calculate your fixed expenses, plus leave a reasonable cushion. It’s up to you to decide what makes sense.

I’m living on a lavish $60,000 salary which works out to $5,000 a month. There are people doing far, far better than I am. I hope they shame me in the comments. The point is that you need to come up with a number that is reasonable for you. Keep in mind that this number excludes payments on debt, retirement savings, etc. I’m also trying to capture as many reimbursable expenses as possible. The number you pick is an artificial limit for your living expenses.

If you get the number wrong, it’s very easy to adjust this later, so don’t worry about it too much.

A Few Reasons To Artificially Limit Your Income.

- You recognize that you have no idea or experience on handling a $225,000 income and that it’s a wise move to start lower.

- You recognize the value of anchoring yourself at a lower income to start.

- You are excited about the idea of banking/saving so much money and are willing to do whatever it takes to ensure you “capture” as much of this income as you can.

- You are unsure whether a Biglaw career will be for you and you want as much of a cushion as possible because it gives you the flexibility and options to pursue a different career path if you want.

- You have a fixed amount that you want applied toward your debt each month (and you’ve refinanced your student loans) and you want to separate that payment from your discretionary income for physiological reasons.

Setting Up Your Accounts. I’ve created this handy image to show you how the cash flows in a “set your salary” financial system. This particular setup may or may not work for you but could be a good starting point.

Fixed Salary. After you’ve calculated the salary you need, contact HR and set up the fixed amount to be transferred to your main checking account each pay period.

Everything Else. At the same time as you set your fixed salary, tell HR to send “everything else” or the “available balance” to Vanguard or your savings account of choice.

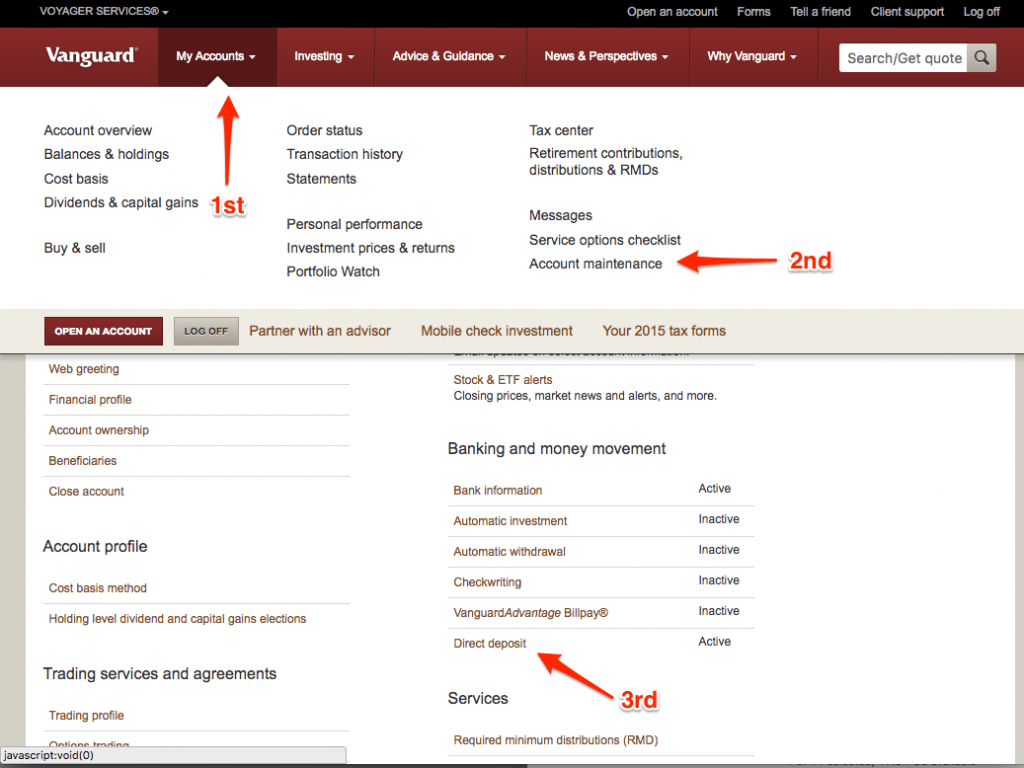

It’s easy to set up direct deposit with Vanguard, but for some reason they’ve hidden the information. You’ll need to log on to your account, select My Accounts / Account Maintenance / Direct Deposit as shown below.

How it works in practice

It’s payday – hurrah. Your fixed amount will be deposited into your main checking account. It’s a predictable number, so you’ll know what to do with it (pay rent, etc.). Everything above the fixed amount will be deposited into your Vanguard account. From there you invest the extra money according to your preferred asset allocation.

Over time you’ll notice that the “available amount” deposited each month goes up twice a year: (1) when you’ve paid the full amount of annual Social Security tax and (2) when you receive raises each year.

Ready to give yourself a raise? Whenever you think it’s appropriate to bump up your salary, it’s as simple as making one tweak with HR to increase the amount going to your main checking account. I think you’ll find this system flexible as you move through the ranks.

What if I’m Still Paying for Student Loans? Increase your fixed salary to cover the amount you want to pay toward student loans. Think you can live on $5,000 and pay $3,000 toward student loans? Set the fixed salary deposit at $8,000 a month and send everything else to Vanguard. Once the money hits your main checking account, set up an automatic sweep to move the student loan money to a separate checking account held at the same bank. Make all of your student loan payments from the separate checking account.

All roads lead to rome

As you may have guessed, there is no one right way to do this and the strategy can apply no matter your income level.

The important point is to allow yourself to grow into your salary over time rather than all at once.

If you take the time to set up a system now – even if your “available balance” is only an extra $100 – it will pay immense dividends to you over time.

Do not become the fifth year associate making all that extra money each year with nothing to show for it.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is currently looking for additional lenders to add to Biglaw Investor’s JD Mortgage service which connects readers with lenders offering special mortgages for high-income professionals.