Buying a traditional diamond ring means spending a lot of money for a tiny object. Generally, I’m not a fan of buying insurance I don’t need. However, there were several factors that led me to decide that buying insurance on a diamond ring made sense.

Why buy insurance on a diamond ring?

Standing in the middle of a field, at the edge of a forest, there’s a lot of emotions going on when you get engaged. In my experience, buying insurance isn’t on the top of your mind.

But seeing the ring “in the wild” gets you thinking, “What happens if that gets lost?”

Normally, I do not like to buy insurance for items where I can self-insure. Buying an extended warranty for a TV purchase? No thanks. I can take the risk of loss myself and replace the TV if it blows up in the third year.

On the opposite end, there’s things like life and disability insurance where I wouldn’t hesitate to pay. I’m not yet at the point where I can self-insure for those events.

In the middle, there’s housing and car insurance, both of which make sense. But what about a diamond ring?

My first instinct was to skip the insurance. I could easily cover the loss. It’d be painful to lose that money, but it could be done. Isn’t that the definition of self insurance?

But there’s another factor at play here: relationship insurance. My fiancé would be incredibly upset if she lost the ring. She’d blame herself, even if it wasn’t her fault. If we didn’t have insurance, she’d probably insist on getting something cheaper to replace it.

That’s not how I want us to feel about the engagement ring. If it gets lost or stolen I want us to be upset but still think, “Oh well, $h!+ happens!”.

Searching for insurance options

First stop in any discussion about diamonds, is to head on over to the Pricescope forums. The people who contribute to that community know what they’re talking about.

The forums contain a lot of posts covering Jewelers Mutual. They are a standalone insurance company that only provides insurance on jewelry.

Jewelers Mutual will let you select a deductible when writing the policy. I have no interest in having a $0 deductible – I am more than happy to take a hit of a few hundred dollars if something goes wrong.

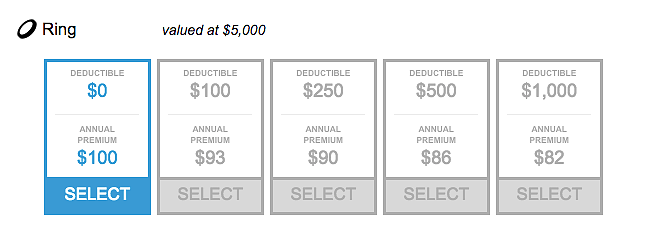

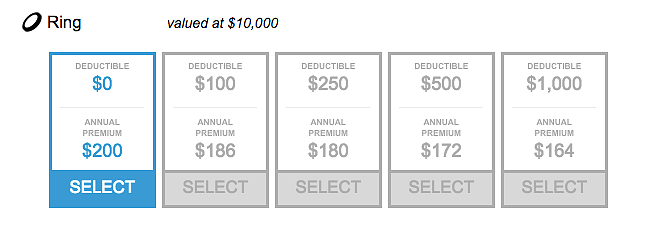

I requested two quotes from JM: one for a $5,000 policy and another for a $10,000 policy. You can see the premiums and deductibles outlined below.

Jewelers Mutual: Insuring a $5,000 Diamond Ring.

Jewelers Mutual: Insuring a $10,000 Diamond Ring.

Of course the premium on the policy is only one part of the equation. You’re also going to want to know what is covered.

Jewelers Mutual seems to have wide coverage, as also evidence by the generally good reviews. According to their website, their insurance policies cover loss, theft, damage and “mysterious disappearance”. They also cover worldwide losses.

Once you file a claim, they advertise that they will repair or replace the jewelery with same kind and quality (up to the value on your policy) from the jeweler of your choice without the need for multiple estimates.

I appreciated that they provided a sample policy online for review. Just FYI, but loss of the ring due to nuclear hazard is not covered. I guess you might have other concerns at that point anyway.

Why I decided to go with USAA insurance

I also requested a quote from USAA as they already provide me with renter’s insurance and had good reviews on Pricescope.

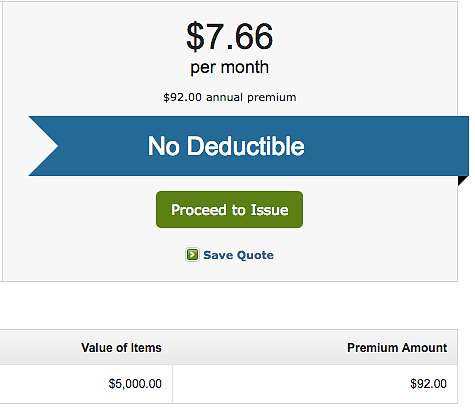

I requested the same quotes from USAA and you can see the premiums they provided below.

USAA: Insuring a $5,000 Diamond Ring.

USAA: Insuring a $10,000 Diamond Ring.

Both USAA quotes are lower than those provided by Jewelers Mutual, however if you are willing to pay a deductible, you can get a better price on the Jewelers Mutual policies. USAA did not offer the option of increasing the deductible and therefore lowering the premium.

For me, the big difference is that USAA will offer a discount of approximately $50/year on my renter’s insurance. This “savings” knocks down the price of the Valuable Personal Property policy enough to tip it to USAA.

Plus, one of the principles of my investing policy statement is to make things simpler when I have the option. Keeping two insurance policies with the same company furthers that principle.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money and is always negotiating better student loan refinancing bonuses for readers of the site.