Recently I was explaining to a reader the difference between VTSAX and VTSMX. They’re both the Vanguard Total Stock Market Index Fund but one is the “Investor” class of shares and the other is the “Admiral” class. Both are designed to provide investors with exposure to the entire U.S. equity market and both track the same assets. The “Investor” class comes with an expense ratio of 0.16% while the “Admiral” class only costs 0.05%. Since cheaper fees are better, you’d think everyone would buy the “Admiral” class but the “Admiral” version is only available to investors who have a minimum of $10,000 to put into the fund. Meanwhile, you can get started with the “Investor” class for as little as $3,000.

After you save up the $3,000, you can add investments in any increment. It’s a common misunderstanding to think that each purchase needs to be $3,000. Not true. Once you hit the minimum, you can add as little as you want to your position. By the time you’ve accumulated $10,000, Vanguard will ask if you want to switch to the cheaper “Admiral” shares. You do. So just say yes and you’ll forever be in the lower cost mutual fund.

But the reader also wanted to know the difference between the index mutual funds and the ETF version. That’s because there’s a third option to purchase the Vanguard Total Stock Market via an exchange traded fund (ETF). The ETF version is called VTI.

What is an exchange traded fund (ETF)?

An ETF is a marketable security that tracks an index (or some other basket of assets). Unlike a mutual fund, an ETF trades on a stock exchange like a common stock. The price of an ETF fluctuates throughout the day as they are bought and sold. This is different from a mutual fund which has a net asset value that is calculated at the end of every day.

Other than that, there’s not a lot of differences. ETFs have higher liquidity since they are being bought and sold all day long, but for your average lawyer looking to build a nest egg, this isn’t going to me much of a concern to you.

The advantages of ETFs are that since they are traded like common stock, you can purchase them with any brokerage account. A disadvantage is that you’ll probably have to pay a commission for each trade you make. This is different from purchasing shares in an index fund directly from Vanguard (or other mutual fund companies) where there are usually no transaction fees.

A lawyer who has a 401(k) that is basically a brokerage account might have to pay $8.95 each month that he purchases an interest in VTI, whereas he’d likely be better off if he was able to invest directly into the mutual fund and avoid those fees.

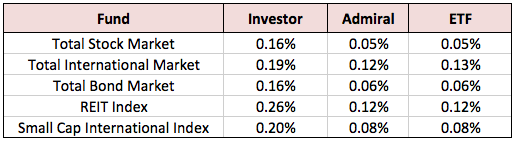

On the other hand, ETFs have very low fees. Let’s look at the actual fees of some Vanguard funds.

As you can see, except for the Total International Market, there’s no difference between the “Admiral” class and the ETFs. The fees are low throughout. In fact, the fees associated with the more expensive “Investor” class of shares are pretty cheap as well.

Most new investors who have figured out that fees can eat into a gigantic part of their return are upset to find they are paying fees in the 2-3% range per year. It’s really not hard to reach that amount when you have advisor fees, higher expense ratios and hidden 401(k) fees. Once you get your fees down to 0.26% (the highest example in our chart) and below, there’s not as much room for improvement.

Since the ETFs are bought and sold in the market, there’s no minimum investment amount which can be good for investors just getting started. However, if you’re paying $8.95 per trade, you’re saddling yourself with a high fee that could be avoided if you just wait and save up the $3,000 and invest directly with Vanguard. The other consideration is that when you purchase on the open market you have to deal with the market fluctuations and paying any spread between the bid-ask prices. You might inadvertently pay more (or less) money than you would if you have purchased the shares at the end of the day when the mutual fund prices are calculated.

Benefits vs disadvantages

To summarize the benefits vs disadvantages:

ETF Benefits

- Trade during the day, so you can jump in and out.

- Fees are as low as “Admiral” class funds.

- Can be purchased from any brokerage account.

- No minimum account balances.

ETF Disadvantages

- Trade during the day, so you can jump in and out.

- May be subject to brokerage commission fees per trade.

- More hassle, since purchases are made through a brokerage during trading hours and with market orders.

- Possible bid-ask spread price differences.

- You may be more likely to get caught up in the daily movements of the ETF price.

If you have enough money to purchase into the “Admiral” class of shares (usually $10,000 but sometimes higher), and if you want to minimize the hassle, I think the mutual funds are the way to go. It’s much easier to automate purchases of mutual funds over ETFs and I find it more convenient to make purchases when the market is closed rather than having to make purchases during market open hours.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

I was excited to see the title for this post come up because this was something I didn’t understand all too well until recently. I’m currently with TD Ameritrade for my Roth IRA (and my wife’s) and was looking to switch to Vanguard. However, Ameritrade has the audactity to charge you to leave them ($50!). In their defense, it looks like most of the major brokerage firms out there do that (not Vanguard though!).

Anway, I decided to stay with them after I found I could buy the Vanguard Total Stock Market ETF (VTI). Ameritrade offers that as a no-commission offering. So I get to still go after the low expense ratio offered without associated fees. Not a bad deal – especially since I get a lot of the benefits you mentioned.

— Jim

Perfect, that’s a good solution. I guess this would also work if your 401(k) allowed you to invest in individual securities but didn’t have access to Vanguard index funds.

One more you did miss. Etfs are more tax efficient. Due to their structure mutual funds require them to pay out almost all their capital gains yearly. Etfs do not. Index funds tend to be low on cap gains anyway, especially when the fund is inflowing so you do see this ramification less.

I didn’t know that. Thanks for leaving the comment. That could be important for some people looking to minimize capital gains taxes.

I appreciate learning why ETFs are more tax efficient. Thanks, Full Time Finance. I hope that becomes more of a concern for me in a few years.

Exactly. Good for a taxable account. Not a concern when it’s tucked away in your retirement accounts.

My brokerage account and Roth IRA are all mutual funds. I don’t want the hassle of trying to “get in at the right time” during the day. I just log online, press buy shares and select my amount. I like to keep investing simple and ETFs add another layer of complexity.

Great post. The difference between all of these can be confusing sometimes!

Under a 401(k) I exclusively use mutual funds over ETFs. 401(k) plans vary, but I’m fortunate enough to have access to a few very low-cost funds (vanguard intl, fidelity us total, fidelity bond) and there are no minimums. Likely because it’s a company plan.

Outside of that I like to use Fidelity to get access to iShares since they trade commission-free when bought through a Fidelity brokerage account. This eliminates the need to meet any minimum. Once enough capital is built up in those accounts I’ll be switching to mutual funds since you are able to buy fractional shares (unlike in an etf), eliminating any extra cash sitting in the brokerage account.

Of course, any move from ETFs to Mutual Fund will have to be evaluated for tax impact.

Good point on shifting from ETFs to Mutual Funds (or vice versa). You certainly don’t want to incur capital gain taxes if you can avoid it, assuming you’re in the accumulation phase of a career.