Many lawyers understand that taxes are their biggest expense each year and are looking for ways to shave their tax liability and lower their tax bracket. One of the best retirement accounts available is the Roth IRA.

High-income earners can contribute to the Backdoor Roth IRA, which is a simple two-step process for getting an annual contribution of $6,000 into a Roth IRA, even if you are over the income limit.

Contributing $6,000 every year for the next 30 years to your retirement savings, you could end up with a beautiful side account worth $512,000+

Are you considering a strategy to invest taxes into a Backdoor Roth IRA? Here is a comprehensive step-by-step guide for popular reference.

What is a backdoor Roth IRA?

A Roth IRA is an individual retirement account (IRA) containing investments with tax benefits like tax-free growth and qualified tax-free distribution or withdrawal (extenuating exemptions also available).

A traditional IRA offers tax-deferred growth, but a Roth IRA gives you tax-free distributions in retirement.

Here’s how that works: You pay taxes on the amounts contributed to a Roth IRA today in exchange for not having to pay taxes in the future. Roth IRAs are a great strategy for ensuring you have access to before-tax and after-tax dollars in retirement.

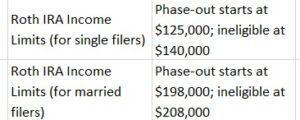

Congress has limited those who can contribute to a Roth IRA to taxpayers who earn below $140,000 for single filers and $208,000 for married filing jointly (subject to annual variations). Unfortunately, these eligibility income limits exclude most lawyers from being able to contribute.

But there’s a catch: Since 2010, the government allows anyone, regardless of income, to convert a Traditional IRA to a Roth IRA by paying income tax on any account balance being converted that has not already been taxed.

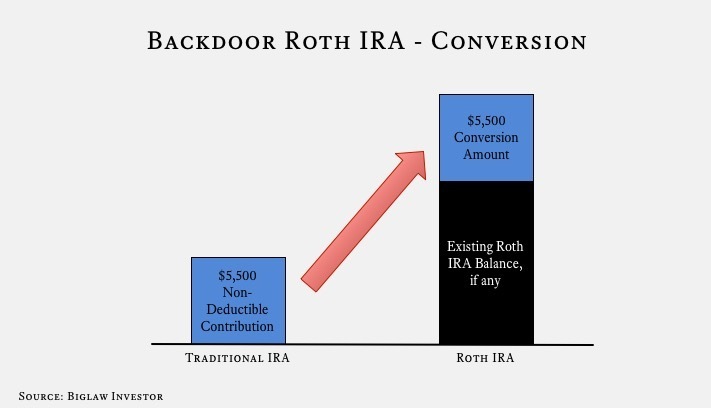

Therefore, you make a Traditional IRA contribution of $6000 (the contribution limit as of 2021) each year. Because your income is likely too high to allow for this contribution to be tax-deductible, your contribution is known as a non-deductible IRA contribution.

It’s “non-deductible” in the sense that you can’t take a tax deduction on the contribution on this year’s tax return and therefore must pay income taxes. However, no matter your gross income, anyone can make a “non-deductible” contribution to a Traditional IRA up to that year’s limit.

From there, you simply convert the “non-deductible” contribution from a Traditional IRA to a Roth IRA. Because you already paid taxes on the “non-deductible” contribution to the Traditional IRA, there are no taxes to pay on the conversion.

Regardless of your income, anyone can convert money in their Traditional IRA to their Roth IRA, hence the “backdoor” two-step process of getting money into a Roth IRA if your income is too high to make a direct “front door” contribution.

The end process leaves you with a $6,000 contribution to your Roth IRA.

Does the IRS approve of the backdoor Roth IRA conversion?

I’m not aware of any situation where the IRS has reversed a Backdoor Roth IRA. If you know of one, please let me know. I’ve also never seen a tax court case resolving the matter one way or another.

It’s clear that everyone, from Congress to the IRS to the financial institutions, is aware of the Backdoor Roth IRA. Just look at the ads from Charles Schwab and Fidelity:

In fact, Vanguard even mentions the backdoor conversion on its site.

If the IRS or a tax court invalidates Backdoor Roth IRA contributions, we’d have quite a mess on our hands. However, if you have questions or are unsure whether it’s the right step for you, check with a tax professional or financial advisor to discuss any potential tax consequences.

Do I need to contribute via the backdoor?

If you make less than $140,000 as a single person (or $208,000 for married couples filing jointly), you fall within the Roth IRA income limits. In that case, there is no reason to use the “backdoor” because you can make a regular contribution to a Roth IRA.

If your income is above these amounts, you should contribute to a Backdoor Roth IRA.

How to make a backdoor Roth IRA contribution

Let’s get started. My favorite platform is Vanguard, and it’s what I recommend.

Each step below tells you what to do and how to make a Vanguard Backdoor Roth IRA contribution.

STEP 1) Convert/Remove “other” IRAs

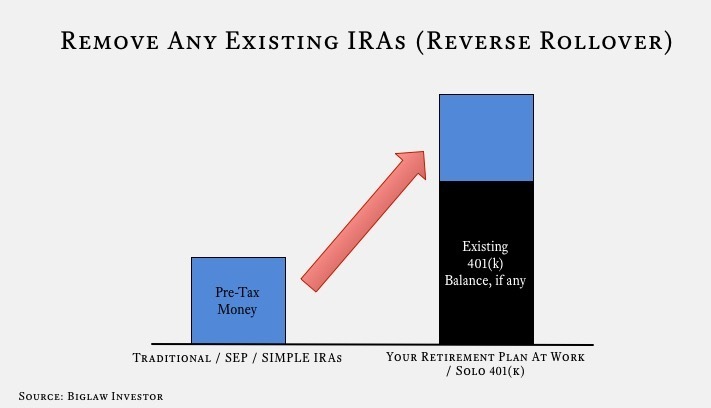

If you don’t have any Traditional, SEP or SIMPLE IRAs with pre-tax money, go directly to step 2. You might have a Traditional IRA if you made pre-tax contributions to an IRA before law school, or you changed jobs and rolled a previous 401(k) balance to a Traditional IRA.

If you do have pre-tax money in an IRA, decide if you want to pay the tax bill on the conversion today (if so, jump to step 2).

If you have a higher income, you probably don’t want this money taxed at your current marginal rate and would prefer to keep it pre-tax so you can withdraw it in retirement later at what’s likely to be a lower effective tax rate.

Assuming you don’t want it taxed, you need to remove the pre-tax money. This is because the IRS won’t let you just convert the non-deductible traditional IRA portion of your IRA. You must convert both the non-deductible portion and the pre-tax money, pro rata, when converting to a Roth IRA. If you’re not careful and skip this step, you’ll end up having to pay taxes on the pro rata portion of the pre-tax money since you’re converting it from pre-tax to after-tax.

By December 31st of the tax year, if you do a Backdoor Roth IRA, you can’t have any pre-tax money in your IRAs (unless you’re planning on paying taxes on any pre-tax money you convert).

You have a few options to remove the pre-tax money in any existing IRAs:

- Pay Taxes Now. As discussed above, you can pay taxes on the conversion today. The pre-tax money will be counted as part of this year’s taxable income.

- Reverse Rollover. The IRS allows you to transfer existing pre-tax money to an employer retirement plan (see IRS Publication 509A). Essentially, you can take all of your pre-tax money and drop it into your work’s 401(k) plan (or something similar). If you have good investment options in your workplace’s 401(k) plan, rolling the money over is a good idea anyway, as you’ll consolidate your pre-tax money in one place. For this, your work’s retirement plan must accept incoming rollovers. Check with your HR department.

- Solo 401(k). If your work’s plan does not accept incoming rollovers, you’ll need to have some self-employment income so you can establish a solo 401(k) plan. You don’t need to make a lot of self-employment income to set this up, just a little money will allow you to set up a Solo 401(k) for yourself, which you can then use to accept the incoming transfer from your traditional IRA.

STEP 2) Make a non-deductible contribution to a Traditional IRA

Now that you don’t have any pre-tax money in your IRAs, it’s time to make the non-deductible contribution to a Traditional IRA. Even if your income is “too high,” you can make a non-deductible contribution.

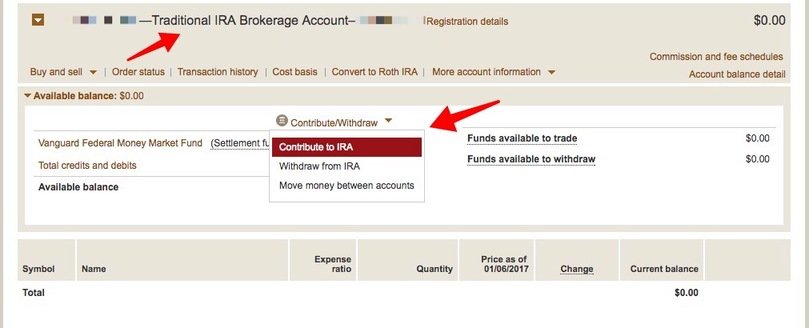

If you don’t have a Traditional IRA account, you’ll need to open one. If you do have one, it should have a zero balance like mine does below.

There are no special steps to make it a “non-deductible” contribution, just make the contribution.

STEP 3) Wait at least one day

Vanguard forces you to wait one day for the IRA funds to settle before you can convert your Traditional IRA to a Roth IRA.

Some people believe you should wait longer and point to the Step Transaction Doctrine as evidence.

In short, the step transaction doctrine is a judicial determination that a series of formally separate steps can be collapsed into a single step for tax purposes. In other words, theoretically, the contribution to the Traditional IRA and subsequent conversion to a Roth IRA could be viewed as a direct contribution to the the Roth IRA, which would be prohibited.

I have never heard of the IRS invoking the step transaction doctrine for a Backdoor Roth IRA contribution. Please let me know if you are aware of it ever being invoked.

I seriously doubt you’re fooling anyone by waiting a week, a month or six months. Regardless, many people would artificially increase the amount of the time between making the “non-deductible” contribution and the subsequent conversion in order to avoid the step transaction doctrine. Me? I’ve always done the conversion the next day.

Vanguard even has a single button you can press to convert the money to a Roth IRA (as you’ll see in the Step 4), so I always assumed the IRS and Congress were fully aware of the “loophole” and would close it if they wanted to.

STEP 4) Convert from traditional to Roth

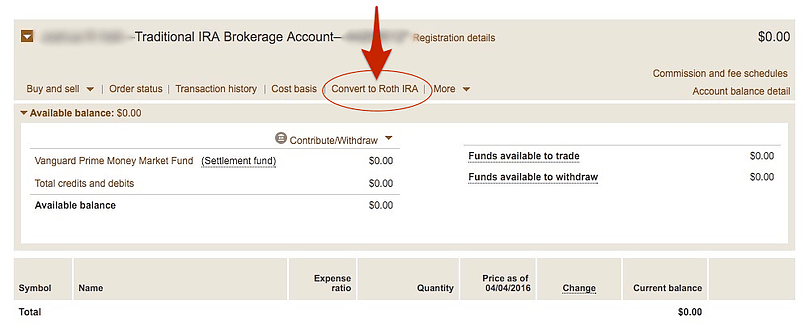

From the Vanguard website, go to your Traditional IRA Brokerage Account and click on “Convert to Roth IRA.”

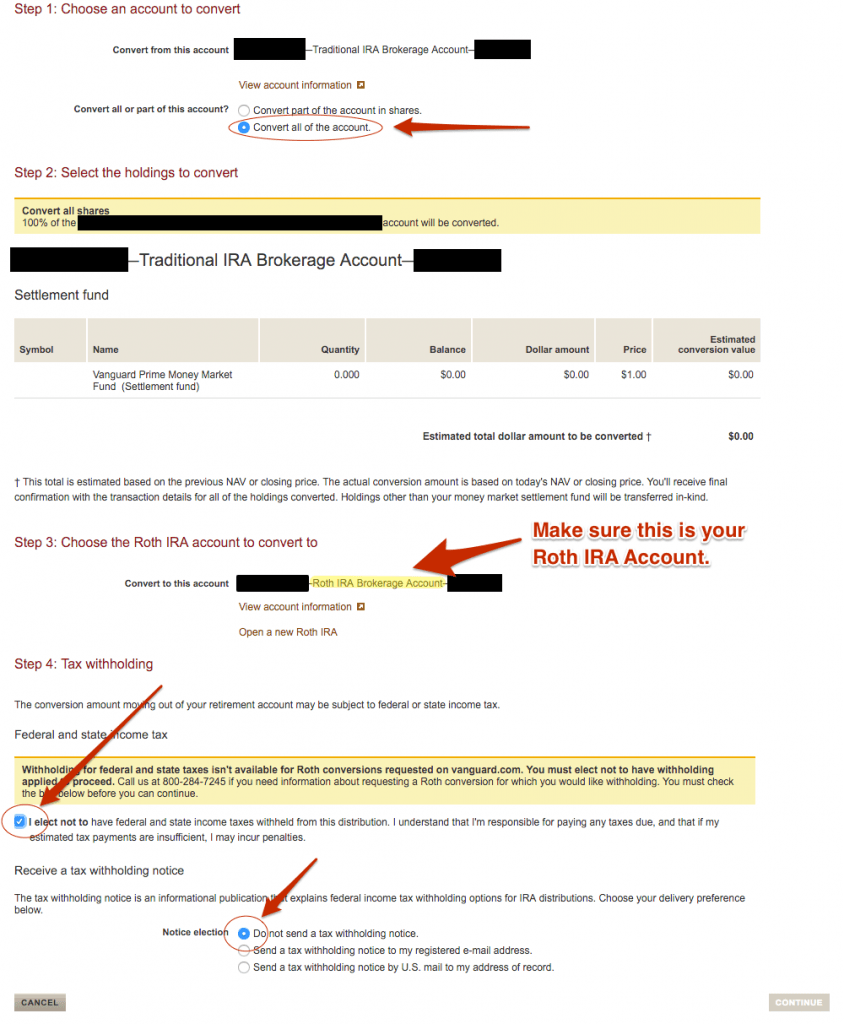

On the conversion page, select that you’d like to convert all of the account into your Roth IRA. If you have an existing Roth IRA, the conversion will roll the funds into your current account. If you need to open a new Roth IRA account, you can do that, too.

At the end of the day, you only need one Roth IRA account, and each year you will roll that year’s contribution into the single account.

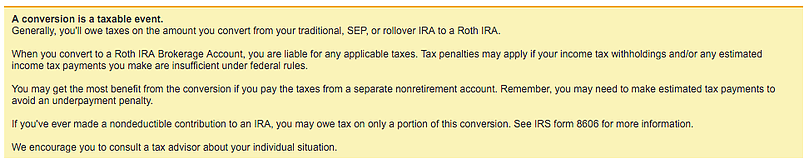

After you click on “Continue,” the website will display a scary tax notice. (Update: This year I didn’t see the scary tax notice, so don’t be alarmed if you don’t get it).

Remember, as we discussed earlier, the conversion from a Traditional IRA to a Roth IRA is a taxable event. In your case, the taxes will be zero, so it’s not a problem. Why? Because you made a non-deductible contribution to your Traditional IRA. Income tax would only be due if you are converting a deductible Traditional IRA (i.e. pre-tax money) into a Roth IRA (i.e. post-tax money).

You’re converting post-tax money into post-tax money, so no taxes are due.

After you have converted funds, congratulations! You’ve made a successful “backdoor” contribution to your Roth IRA. You are now free to invest the money in your Roth IRA account.

STEP 5) Report the contribution correctly on your tax return

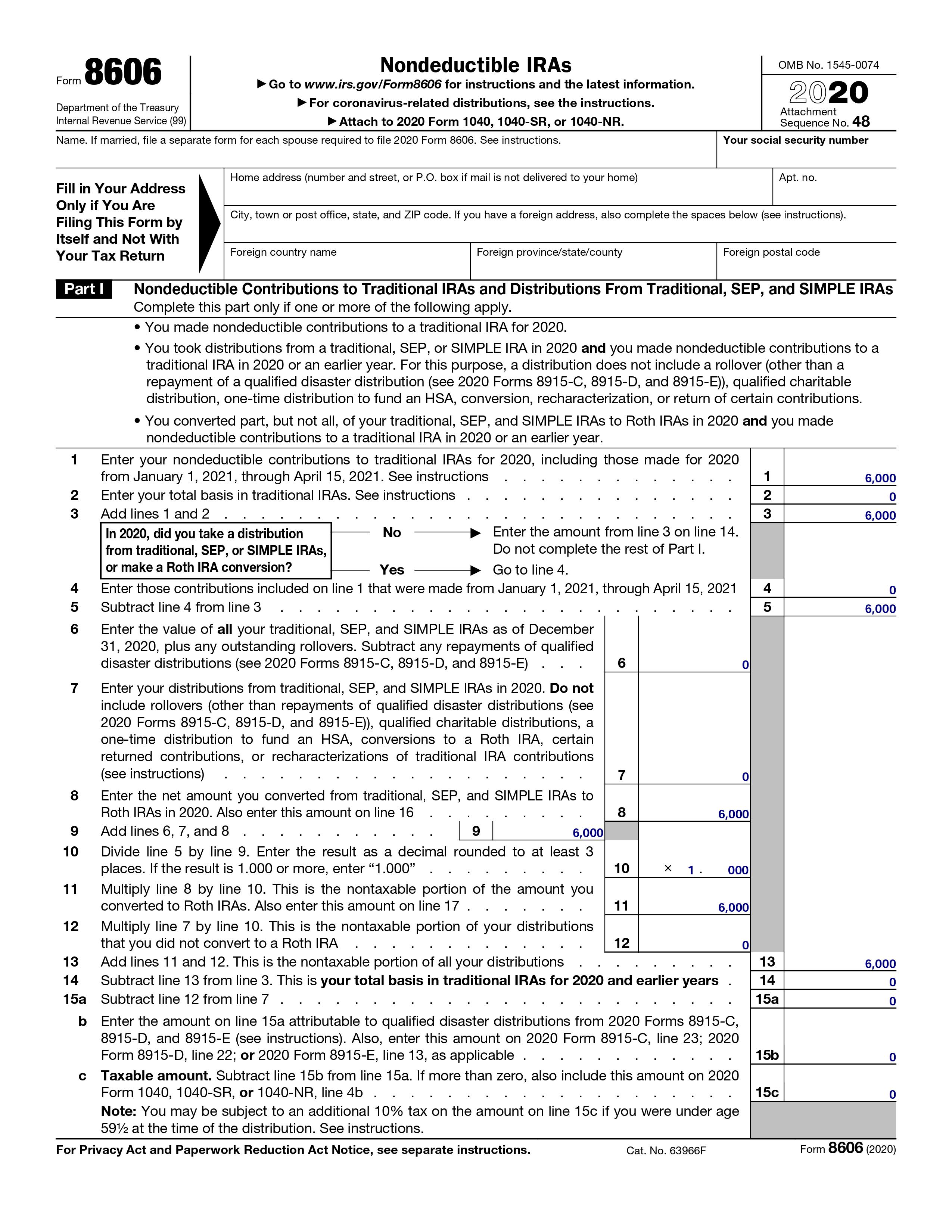

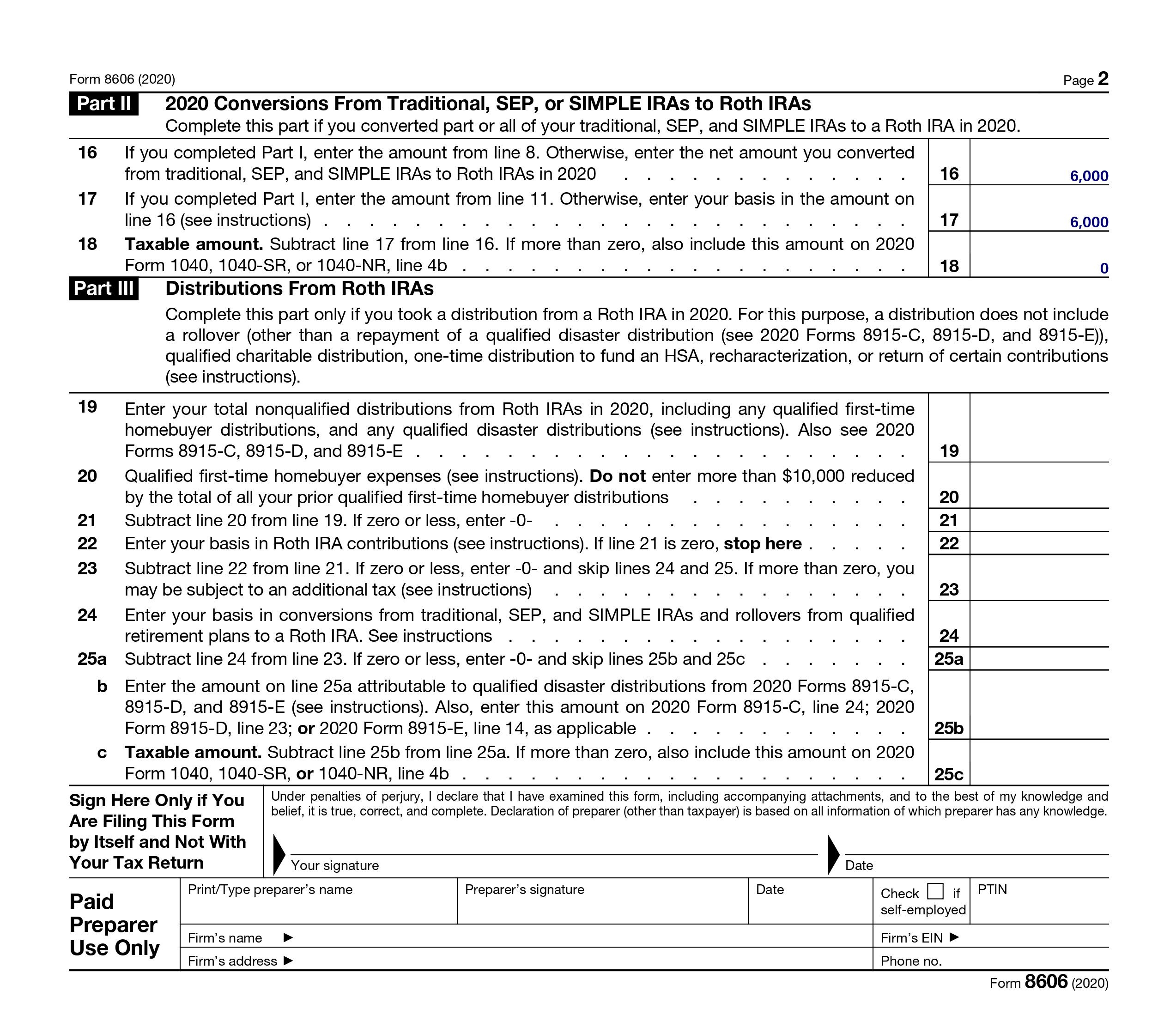

When you report your taxes, make sure you have a correctly completed IRS Form 8606. It’s a short form but there are opportunities to screw it up and confuse the IRS.

Your Form 8606 should look like the image below, unless you’re doing a conversion in a different year from your contribution.

If you’re checking your tax-preparer’s work, focus on lines 2, 14, 15 and 18. All should be a very small amount, likely zero, unless you earned a little interest in the period between making the contribution and doing the conversion. Make sure those lines aren’t large amounts like $6,000.

One interesting aspect of the form is that there’s no place to insert the date you made the conversion (your IRA custodian doesn’t report this either).

Below is how Form 8606 should look:

STEP 6) Repeat next year

Most IRA custodians will keep an account open for a year even if the balance is zero. Therefore, your empty Traditional IRA should be available next year for you to use again when doing your Vanguard Backdoor Roth IRA.

Just remember, you cannot end the taxable year on December 31st with any pre-tax money in your IRA accounts. So, if later this year you leave your employment, you can’t roll your former job’s 401(k) into a Traditional IRA unless you “remove” it again, as described in Step 1.

Will congress close the “backdoor”?

You’re probably also wondering if one day Congress will close the Backdoor Roth IRA. The short answer is no. There have been many discussions about closing the loophole, but as of 2021, it’s still available.

The long answer is that with the Tax Cuts and Jobs Act of 2017, Congress has come as close as ever to officially sanctioning the Roth IRA for high-earners.

The most visible support from Congress for the Backdoor Roth IRA came buried in a conference report released in December 2020 that discusses the TCJA. It looks like we’ve been vindicated, as seen in the following footnotes:

268 Although an individual with AGI exceeding certain limits is not permitted to make a contribution directly to a Roth IRA, the individual can make a contribution to a traditional IRA and convert the traditional IRA to a Roth IRA, as discussed below.

269 Although an individual with AGI exceeding certain limits is not permitted to make a contribution directly to a Roth IRA, the individual can make a contribution to a traditional IRA and convert the traditional IRA to a Roth IRA.

Do these footnotes finally end the speculation as to whether a Backdoor Roth IRA is permitted? I certainly hope so (and several others agree). They’re the clearest guidance we’ve seen that Congress is A-OK with the “backdoor” contributions.

This should comfort a lot of lawyers previously concerned about the step transaction doctrine. Maybe now we need to rename it to the “2-Step Roth IRA” contribution so it will be easier to market!

Some people speculate that Congress is happy to keep the “backdoor” open because each year some people will convert existing pre-tax money in their Traditional IRA to a Roth IRA, thus generating taxable income for the year and raising tax receipts.

Start your backdoor Roth IRA today

Time will tell if the “backdoor” gets closed. Until then, you can take advantage to build a Roth IRA balance even if your income doesn’t allow you to contribute directly.

So, get started with your Backdoor Roth IRA today too boost your personal finances. That’s $12,000 for you and your spouse in a tax-protected account, regardless of your income (or whether your spouse even has earned income).

Have Questions?

What is a Backdoor Roth IRA?

How to do a Backdoor Roth IRA?

Can I do a Backdoor Roth IRA if I have a Traditional IRA?

Can You Still Do a Backdoor Roth IRA in 2021?

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Lots of good info here BigLaw! Very useful for people outside the standard Roth income brackets.

I believe standard contributions do have the advantage of being immediately withdrawable, while conversion contributions from the ‘Backdoor’ must be ‘seasoned’. (If I understand correctly)

Are they any other advantages/disadvantages to the different contribution methods?

That’s correct, all conversions have to be seasoned for 5 years before they can be withdrawn. It does mean that if you haven’t made any direct Roth IRA contributions to your Roth IRA, you can’t really use the Roth as a de facto emergency fund if you’re only making backdoor Roth IRA contributions.

This is a fantastic job. As you and I discussed I currently have an IRA from rolling over my 401K from previous employers.

I am allowed to roll those funds over to my current employers 401K plan, which would allow me to deploy the back door roth strategy without complexity.

However, since I have given this more thought, the funds in my IRA are fully invested, and I use this account for a lot of my option strategies, which have expirations as far out as 2018. I don’t think I want to (1) liquidate those positions early, (2) give up the unlimited options I currently have with my TD Ameritrade IRA account (you are severely limited in a company 401K).

That said, I don’t think I am going to pursue this option like I thought I would.

BUT if I can get a qualified plan set up for my wife’s company, I would be more than happy to implement this with her IRA (by transferring her account to the new qualified plan).

I think my homework is attempt this again in 2017.

Another option is to create a solo 401(k) under GYFG (you don’t need to contribute much from the blog, just a few dollars) and then roll your existing IRA into it. Presumably you could do this with TD Ameritrade and keep the account intact. I don’t know for certain, but I also thought if you do “custodian to custodian” rollover transactions you aren’t actually liquidating the position, so you won’t have to worry about terminating options / selling assets and then repurchasing them in the new account.

I’m so happy I just found your blog! Love your content. My story doesn’t make me quite your ideal audience; as it turns out, I was accepted into top law schools around this time last year and declined because I was terrified of the debt. It was scary but the journey since has been so much more exciting. Your “Start Here” page really spoke to me, though, in the huge myth 20 somethings have that they’ll work in big law for 2-3 years, pay off their loans, and bail. So many voices in my head just kept telling me it just. doesn’t. work. that. way., which is why I made the decision that I did. No regrets! But, I definitely will always wonder the sort of lawyer I would’ve been.

Sometimes having so many options is more of a blessing than a curse! Anyway, thanks for writing this great content. I’ll be back.

All the best,

Leah

http://www.urban20something.com/

Smart move. A lot of people go to law school for the wrong reasons (i.e. they think they’ll make tons of money). If you really want a law degree, you could always get one later or through a part-time program. Sometimes the best answer to a potential pre-law student is just to say “maybe NOW isn’t the right time to go to law school” – re-evaluate in a couple of years and see if you feel differently.

Hey Josh! It’s Taylor 🙂 So happy that I have learned about this blog and so grateful that you are doing it. I spent hours on it last Saturday and followed all of your advice. I am trying to follow this how to guide but I’m getting stuck on opening the Roth IRA account. I already opened the traditional IRA (at Vanguard) and made my max 2016 contribution. Now I’m trying to open the Roth IRA so that I can convert the traditional IRA. But when I reach the page during the Roth IRA account opening process that asks me to make a contribution, it won’t let me continue with a contribution of $0. But I know that I can’t make Roth IRA contributions directly. Do you know how I skip the initial contribution? Thank you!

Hey Taylor – Glad you’re finding the site helpful! Do you have the option to convert to a Roth IRA when you’re looking at the Traditional IRA summary as shown in this picture:

https://www.biglawinvestor.com/wp-content/uploads/2016/07/Convert-Traditional-IRA-to-Roth-IRA.png

I’m not sure that you have to open a Roth IRA account in advance of the conversion. I think you can just convert the Traditional IRA to a Roth IRA (which will do all of the account opening for you) but I’m not 100% sure about that.

If you don’t have the option to convert to a Roth IRA (as shown in the picture), I’d give Vanguard a call and explain that you’re trying to do a backdoor Roth contribution and ask them what to do next. They will be familiar with the backdoor Roth.

Hello, my non-deductible traditional IRA contribution grew in the 30 days I waited to convert to the Roth IRA (from $5,500 to $5,503). Should I still choose “covert all” on the Vanguard site, or choose only the contribution limit of $5,500? If so, what should I do with the remaining $3 in the traditional IRA? If I covert all, I recognize that I’ll pay taxes on that growth, but won’t I be going over the $5,500 limit? Any help is appreciated. I get confused on these points yearly.

Patrick – Sorry for the delayed reply! This isn’t really a problem and I hope you figured that out without having to wait for me. Your $5,500 contribution to the non-deductible traditional IRA met the requirement that you are only allowed to contribute $5,500 to your IRA each year (so no problems there).

After that, if you choose “convert all” (which you should) and convert any gains, you are creating a taxable event solely with respect to the gains, which in your case is $3. That $3 in gains will be taxable when you fill out your 2017 income tax return.

I avoid these minor headaches by doing the conversion the next day.

If you meet certain conditions (i.e., have the right kind of 401(k) at work), you can execute the Mega Backdoor Roth, which is a way to accomplish what you describe above on a larger scale. The article below explains it pretty well:

https://www.whitecoatinvestor.com/the-mega-backdoor-roth-ira/

Sorry your comment got caught in the spam filter Jennifer. The Mega Backdoor Roth IRA is a great tool if you’re eligible. In addition to Jim’s excellent article you linked to, I wrote about it here: https://www.biglawinvestor.com/mega-backdoor-roth-ira/

Hey Josh, are you making your non-deductible contributions every pay check, or are you doing one lump-sum contribution beginning/end of year? I know there are dollar cost averaging arguments/counter-arguments, but I am more curious whether doing one conversion per year is seemingly more under the radar than 12 conversions. Thanks!

I do one lump-sum contribution at the beginning of the year. I immediately convert it the next day into a Roth IRA. I don’t really buy the arguments that waiting for some period of time or otherwise taking any actions will save you from the Step Transaction Doctrine should the IRS wish to reclassify it.

Related: Dollar Cost Averaging Is Not For You

Thank you, sir. Keep up the great work, from fellow deal counsel in Denver!

Hi there! Thanks for your post. I just got an email from my CPA (on updates on Tax Year 2018) that states “No More Recharacterization of IRA Contributions. This ends the practice of ‘back-door Roth'”–Do you have any insight about this? Thanks!

Yes. I’d consider firing your CPA.

Backdoor Roth IRAs and Mega Backdoor Roth IRAs survived the recent tax bill. You can still make Backdoor Roth IRA contributions in 2018 (with no changes from previous years). It’s pretty surprising that a professional CPA would miss this and get confused.

The confusion stems from the fact that IRA recharacterizations have been eliminated. What’s a recharacterization? It’s a process that allows you to switch the type of IRA (i.e. Roth IRA or Traditional IRA) through October 15th of the year after you made the original contribution.

Why was it helpful to be able to recharacterize IRAs?

From the Boglehead wiki:

“If the value of your IRA decreases after a conversion, you can recharacterize the conversion, avoiding the tax on the original conversion, and then convert the IRA at a lower value for a lower tax bill. This is the most common way to save taxes with a recharacterization. This will be disallowed starting in 2018.

Example: You converted a $10,000 IRA to a Roth in April 2008, and expected to pay $2500 tax on the conversion because you were in a 25% tax bracket. In March 2009, your Roth has lost 40% of its value since the conversion. You recharacterize the conversion, and no longer owe any tax on it for 2008, leaving you with $6000 in the original IRA. In April 2009 (at least 31 days later), with the IRA now worth $7000, you convert it again; you will owe $1750 in taxes for 2009 on the conversion, saving $750 in taxes.”

Since you can no longer do an IRA recharacterization, this means that once you convert your Traditional IRA to a Roth IRA you can no longer go back. That’s fine for us because we’re making a non-deductible contribution anyway (so already paying taxes on the money) so there never was a scenario where you’d want to undo a Backdoor Roth IRA contribution anyway.

Hi Josh – question about step 1: I have an old Traditional IRA and no way of doing a reverse rollover or opening a solo 401(k). Do I need to convert the old Traditional IRA if I want to try a Backdoor Roth or could I open a new Traditional IRA and use the new account? If I have to convert, is there a way of modeling whether the tax hit at the current marginal rate would eventually be outweighed by the benefits of being able to save via the Backdoor Roth? (For context, there is only about $7000 in this old IRA, so conversion wouldn’t be the end of the world but I’d prefer to avoid that if I can just open a new account.)

If you can’t “hide” the Traditional IRA by doing a reverse rollover (bummer – your employer won’t let you?) or opening a solo 401(k), then your options are pretty much limited to converting it into a Roth IRA. Since it’s a relatively small balance, I probably wouldn’t worry about it too much and just do the conversion. You’ll pay income tax on the $7K at potentially a higher marginal rate than you would in retirement but you’ll get the money in a Roth account where it will never be taxed again. The ~$2-3K in taxes you may pay upon the conversion is worth the price of being able to do Backdoor Roths going forward.

The reason why you have to convert the $7K and can’t just open a separate account to make your Backdoor Roth IRA contribution is that on Line 6 of Form 8606 you’re required to report ALL Traditional, SEP and SIMPLE IRAs, so the IRS will force you to convert the deductible contributions pro-rata if you do not convert the entire balance of your IRAs.

Hi Josh,

to maximize my backdoor-Roth IRA contributions, I made a my 2015 non-deductible $5500 contribution to my Trad. IRA in early April 2016. Then, I converted that amount on 4/25/2016 to Roth, so I am carrying a basis forward (not the clean backdoor way, but I was able to get a 2015 contribution in, when I found out about this backdoor Roth IRA in early ’16).

Mistake #1:

I continued to make monthly contributions to my Trad. IRA, and on 12/31/2016 I had about $3263 in my Trad. IRA. This amount seems to have screwed me on my 2016 Form 8606, as it was essentially subtracted from my nontaxable portion, in line 6. (I wasn’t aware of the $0 on 12/31 strategy at the time).

To double-screw myself, in calendar year 2017, I made about $3250 of non-deductible contributions for 2016, so that was also deducted from my nontaxable portion calculation, in line 4.

It seems like I did the two things you should avoid – does that sound right to you?

Great info, thanks! Do you know if E trade has a one button conversion feature?

It seems like it. Here are the instructions for etrade:

https://us.etrade.com/knowledge/library/retirement-planning/think-about-roth-conversion

Thank you!

That’s correct, all conversions have to be seasoned for 5 years before they can be withdrawn. It does mean that if you haven’t made any direct Roth IRA contributions to your Roth IRA, you can’t really use the Roth as a de facto emergency fund if you’re only making backdoor Roth IRA contributions.

Hi Josh,

I did a backdoor conversion last year for the first time. Never had an IRA before and of course will not claim a deduction for it. However, I received a 2020 Form 1099-R from my broker (Vanguard). It indicates the entire amount is taxable. Is this cause for concern with this years tax return?

Hi John –

Congratulations on doing the backdoor conversion! That’s awesome. No, you should not be concerned. The entire amount of the contribution is in fact taxable and will be reported as taxable income (it’s ultimately a Roth contribution, so that makes sense). To ensure that you aren’t double-taxed (i.e. taxed on the income AND taxed on the conversion), you’ll have to file Form 8606 as shown above in Step 5.

Joshua – Thank you! That is what I thought but just wanted to confirm since it’s my first time doing this.

No problem. Now you get to watch it grow!

If BBB passes, this back door and the mega back door are going to close. A post with advice on how to reallocate funds earmarked for tax advantaged accounts would be a big help! I didn’t think I’d need to think about what goes in the taxable investment account for years, but it looks like it happened a little ahead of schedule.

I am a first-year big law associate that just started in November 2021. I plan to do a Backdoor Roth in 2022. My firm’s Vanguard plan does not kick in until the end of February 2022 — in other words, that is when pre-tax paycheck contributions can begin. Is there a best time to do the Traditional–>Backdoor Roth conversion? Should I wait until December 2022, or is it just whenever I can get $6000 into the Traditional Roth? Thanks so much for your help!

Are you thinking of doing a Mega Backdoor Roth or just the Backdoor Roth? I’m a little confused by the fact that you mentioned your firm’s Vanguard plan (is that the 401(k)?). The Backdoor Roth IRA is handled separately and outside your 401(k). Next time you’re on the site, use the Intercom Messenger button on the bottom right and send me a message so we can untangle what you’re trying to do.

Does is make sense that my 100-R has $6003.08 on lines 1 and 2, even thought I deposited and rolled over $6,000 (the limit) in 2022? What should I put on my 8606? Thanks.

How do you avoid interest payments from the Vanguard cash settlement from paying to your IRA and, thus, having to deal with the pro rata rule?

The easiest way is to make the contribution and then roll it over to the Roth IRA the next day so that no interest accrues.