Recently a reader sent in a comment:

I really feel like you brush over the issue of whether the market will be the same in the future.

I couldn’t help but completely agree.

I do brush over whether performance of the stock market will be the same going forward as it has been historically.

Why?

Because my crystal ball is cloudy and so is everyone else’s.

The truth is that on the macroeconomic level, nobody has a clue how the market will perform in the future, whether that’s the next couple of months, years or decades.

Macroeconomics studies the performance, structure, behavior and decision-making of an economy as a whole. It includes national, regional and global economies. It includes technological innovations, inflation, unemployment, consumption, investment, international trade and international finance.

In short, the future performance of the stock market contains a bazillion different factors that are impossible to predict, so the ugly truth is that we have no idea how stock markets will perform in the future.

Worse, it’s next-to-impossible to predict the movement of even certain asset classes. Harvard has the brightest minds in the world and access to literally every investment opportunity, yet even the Harvard endowment can’t beat a bunch of passive index funds.

To a risk-averse lawyer (i.e. all of us), that might raise your legal spidey senses to the point of analysis paralysis.

If we have no idea what will happen in the future, then what do we do?

Well, it turns out that there aren’t a lot of options (and sitting on the sidelines isn’t an option).

Listen to the talking heads for advice

There’s no shortage of people willing to try to predict the future. If thousands are doing it, some of them are bound to be right. That doesn’t mean they can do it consistently.

More often than not, the talking heads are simply selling entertainment. They have a vested interest in keeping you engaged which leads to recommending different strategies, following the daily movements of the stock market and headlines like “This Year’s Hottest Asset Class”.

You can safely ignore them.

If they could predict future economic performance, why would they have a day job on TV telling everyone else about it? It doesn’t make sense.

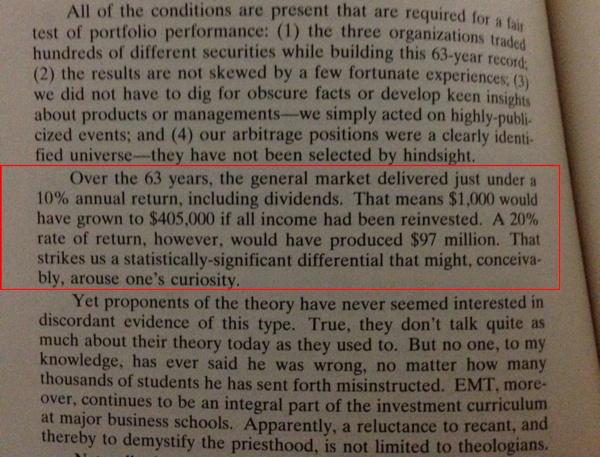

It reminds me of a passage from Warren Buffett where he points out the difference in being able to achieve an extra 10% return.

If you could consistently predict the future performance of the market, would you sign up for a six-figure TV contract or would you prove it to a few wealthy individuals and then start managing their money for a 1% annual fee?

If the talking heads can predict the future, they are woefully underpaid for their services.

Using historical data as approximation

If everyone is unable to accurately peer into the future, what else can we do?

Well, thankfully we have access to historical market data that includes stock market performance during consequential events like the Great Depression, World War II, Vietnam, inflation in the 1970s, Black Monday and the Great Recession.

Does this mean the the average historical market return guarantees future performance? Heck no. But it’s a reasonable starting point for what we might be able to expect in the future.

The problem with historical returns is figuring out how to bridge the gap between what happened in the past and what will happen in the future.

Multiple investing futures

To bridge this gap, the easiest way to develop a hypothesis for how your investments will do in the future is to simply predict multiple investing futures.

If we take the after-inflation historical compound annual growth rate of the entire stock market and set it at 6.55%, then perhaps we’d want to run portfolio performance scenarios at everything from 4-8% to see multiple possible future outcomes.

Which future will materialize? We don’t know.

But, for now, we can simply examine a reasonable bunch of possible futures to see how they could turn out.

You can use the Compound Interest Calculator to do some rough approximation for how your portfolio will perform in the future. Simply adjust the interest rate to imagine different scenarios.

Compound Interest

Results

Back to basics (Index funds)

Index funds will never be winners, but they will always be runner-ups.

At the end of the day, we can’t predict the future and therefore can’t know how the market will perform.

But we do know that low-cost index funds that capture the entire market (such as the Total Stock Market Index Fund) will give us the market return, whatever that may be.

And at the end of the day, what more can we expect? As a whole, we all own the entire market anyway. That means that if you add up every investor and then average their returns, you’ll arrive back at the same place: the total stock market return.

More to the point, this is why saving money is more important than your investment return anyway. You can’t take advantage of any future market performance unless you have a portfolio working for you in the market to begin with.

And then once you have that portfolio, accepting the market returns (i.e. finishing as a runner-up each and every race) will compound into a small fortune guaranteed.

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He spends 10 minutes a month on Empower keeping track of his money. He’s also maxing out tax-advantaged accounts like 529 Plans to minimize his taxable income.

Worrying is suffering twice, especially when it comes to outcomes over which we have no influence, is more or less my stance when it comes to future market perfomance. It’s a good question for your reader though, and quite on point. Investing or not, at the end of the day, comes down to your outlook on the future of the world. To draw it to an extreme, you can sink all your resources into “prepping” for the end of the modern world, or invest to take part in the growth, if you believe the world will continue to advance.

Worrying is suffering twice. Excellent advice that more people should embrace. Thanks for pointing that out Lars-Christian.

I don’t worry about the stock market, and I’ve stopped tuning in as it isn’t rational. There are a lot of big players and computers – I’m at a disadvantage…

After I read “The Black Swan” by Nassim Taleb, I took this view on the world. I have no idea on the future, why try and predict things I can’t control?

For now, I’m focusing on myself and my business. 10 years from now, I’m going to have multiple companies and enterprises. Will be a fun time!

I’ll be happy to dissect this post and prove it wrong…for anyone willing to pay a small fee.

I don’t spend time worrying about stock market performance, because I have a plan to reach my financial goals with conservative market return assumptions. However, stock market performance during my lifetime will have a major effect on whether I have enough for retirement, or a ridiculous amount for retirement.

I disagree with you here. Yes, it’s true that 95% of “experts” have no idea what they’re doing. These are the Jim Cramers of the world. On the other hand, there are a select few world class investors and hedge fund managers who have a proven record of making accurate market calls (e.g. Jim Rogers, Jeremy Grantham, George Soros). It isn’t all just luck and “buying and holding”.

I’m not sure if you’re saying that there are world class investors who can beat the market or world class investors who can predict the market performance?

There are certainly world class investors who can beat the market. But they are pretty rare and incredibly famous (as they should be).

Investors who can predict the market returns? That’s a pretty big stretch. No doubt many people will try, but I’m not familiar with anyone who can look at upcoming decade and say equities will return X% (and then be right).