Over the last couple of months, I’ve learned a few obscure facts about REPAYE (Revised Pay-As-You-Earn, IBR (Income Based Repayment) and PSLF (Public Service Loan Forgiveness) that are worth passing along.

As most of you know, it feels like you need a professional degree to understand how the student loan repayment system works, particularly for those of you looking for Public Student Loan Forgiveness, which is an added layer of complexity on top of the income-driven repayment plans.

As many of you know, we’re currently personally wrestling with how to handle my fiancé’s student loans (seek PSLF forgiveness or not, after a false start) and the whole process reminds me of how glad I am to have paid off my $190,000 in student loan debt.

Since the consequences of making a mistake during student loan repayment can be huge, it’s a good idea to continue reading and learning about the programs to make sure you’re on track. There’s even an emerging industry of consultants that can work with you to make sure you’re making the right decision (or double-check your math), including one who is a sponsor of this site. You’ve probably noticed him on the sidebar to the right.

But, like you, I’m cheap and not likely to spend money on outside help (after all, we’re lawyers and so should be able to figure it out ourselves!). Yet, a couple hundred bucks isn’t that much to get a “second opinion” on your student loan plan. A second (or third, fourth, etc.) opinion is what helped me discover these little gems below.

So, without further ado, here are some facts I’ve learned that are worth passing along. I hope they’ll be helpful to you as you’re navigating repayment.

REPAYE closed the married filing separately loophole

Under PAYE and IBR, if your spouse brought home some serious bacon, you could file taxes separately and thus calculate your loan payments for your debt based on your lower income. This seemed like a fair arrangement to me. The monthly repayment calculation is based on your income and your debt.

This is particularly relevant for lawyers married to doctors or people in tech, where the other partner is earning a much higher income that completely negates the fact that you’re broke and working for public interest. Under PAYE and IBR, you could file separately and each stand on your own.

Well, the government didn’t agree. REPAYE closed the married filing separately loophole. Regardless of how you file your taxes, you must include both spouses income when calculating your loan payments. If you rely on keeping the income disparity separate between you and your spouse, you don’t want to switch to REPAYE.

Keep in mind that married filing separately is pretty bad for a whole host of reasons, not the least of which is that it doesn’t use the same tax brackets as you’d have if you were both single. So married filing separately is a bad deal too and if you have a high income earning spouse, you might be trading a much higher tax bill for the benefits that come from calculating your loan payments based on your separate income. The MFJ vs MFS decision always need to involve a calculator to figure out what’s right for you.

REPAYE got rid of the IBR payment cap

REPAYE eliminated the monthly payment cap. IBR student loan payments are 15% of your discretionary income but are capped at the monthly amount calculated by the standard 10-year repayment plan when you first entered repayment. In other words, under IBR, even if your income shot up dramatically later in life, you’d never make a payment higher than whatever you would have been paying had you been on the standard 10-year repayment plan from the beginning.

The IBR monthly payment cap is extremely relevant in situations where you have a high-earning spouse. Imagine that you’re pursuing PSLF and have made 5 years of qualifying payments when you marry a fellow lawyer earning a $200,000 salary. If you’re under IBR, you can file your taxes jointly (and therefore take advantage of the tax benefits over filing separately) but your payments can’t go higher than that original standard 10-year standard repayment plan amount.

You could spend the next 5 years making standard repayments and still come out ahead by qualifying for PSLF forgiveness.

Again, the government didn’t like this arrangement. REPAYE eliminated the monthly payment cap. Under REPAYE, you pay 10% of your discretionary income, no matter what. The result is that a married couple could see their student loan payments jump to an amount higher than the 10-year standard repayment plan if 10% of their combined discretionary income is high enough.

Keep in mind that your income will need to be quite high in order for 10% of your discretionary income to exceed the 10-year standard repayment plan amount, so this might not be relevant for your situation. As always, this one requires a calculator to see if you’re impacted.

Many lawyers starting their first jobs after law school aren’t married and probably aren’t thinking about the fact that REPAYE forces you to measure repayment based on a combined income. If thats you, while you might not be married today, will you be in the next 10 years? If that’s a possibility, it’s worth thinking about all of these intricacies when you’re projecting a student loan payoff over 10 years (or longer).

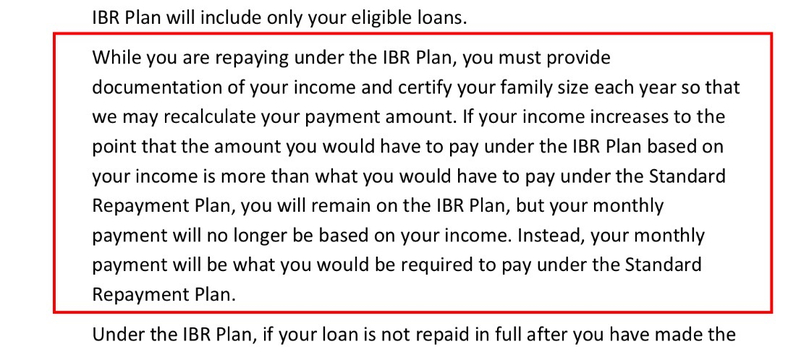

Once you’re In IBR, you won’t get kicked out

To be eligible for IBR, you need to demonstrate a financial hardship. For many lawyers, this is easy to do once you leave law school. Since everyone is working to build their careers and practices, what happens when you no longer have a financial need?

Turns out, you remain in the IBR program but your payments are capped at the 10-year monthly payment amount as discussed above.

This is a subtle point. It would be really important to you if (e.g.) you are in year 15 of a long 25-year plan to have your loans forgiven via IBR and suddenly find your income high enough that you wouldn’t independently qualify to enter into IBR. The provision that keeps you in IBR is baked into the Master Promissory Note itself as seen below.

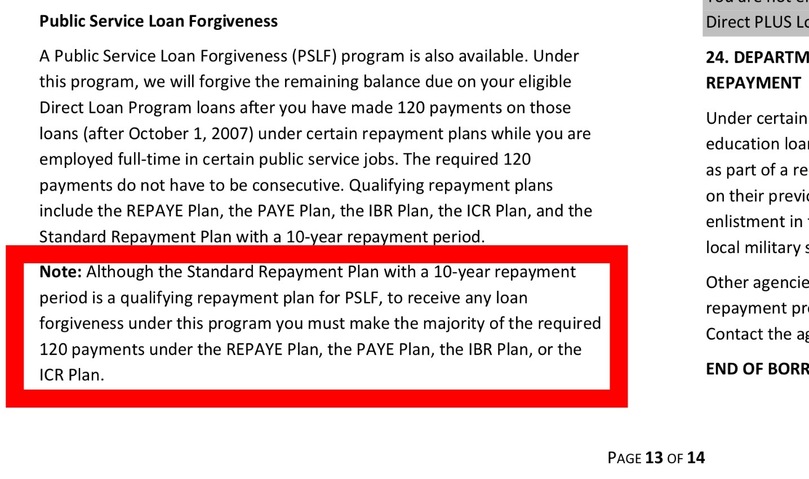

10-year standard repayment sort of counts for PSLF

This might be more quirky than relevant, but I’m pointing it out all the same since it’s something I recently learned.

Payments under the 10-Year Standard Repayment count toward PSLF. The reason for this is that PSLF wants to give you credit for all the months you’ve made qualifying payments. Imagine a lawyer who made four months of payments under the 10-Year Standard Repayment Plan before switching into REPAYE. Assuming all of those payments were made while working for a qualifying employer, PSLF will count them.

Conversely, it makes no sense to make 10 years worth of standard repayments while on PSLF since you’ll pay off your loans in 10 years and receive no forgiveness. Staying on the 10-year standard repayment plan while pursuing PSLF makes no sense.

It turns out that PSLF won’t even let you do that, since the majority of your qualifying payments must be made while on IBR, PAYE, REPAYE, etc.

Again, we turn to the Direct Loan Master Promissory Note for evidence.

Is there a likely scenario where you’re pursuing PSLF and make 61 or more payments while in the 10-year standard repayment plan? Probably not, particularly since IBR won’t kick you out even if your income surges, but either way, if you are pursuing PSLF you should make sure this isn’t you.

The REPAYE to IBR switch-back loophole

As far as I can tell, it is still possible to switch back from REPAYE to IBR during repayment. In the context of the above discussion, if it looks like 10% of your discretionary income under REPAYE (which includes your spouse) is going to be so large that you’ll exceed the monthly payment under the 10-year standard repayment plan, you could in theory switch to your “lower” capped 15% IBR payments.

But, be careful. You can only do this while you still qualify for IBR (i.e. have a financial hardship).

If you wait until your income is so large that you don’t independently qualify for IBR, it’ll be too late to switch.

If you plan on executing this, you’ll need to do a lot of legwork and planning to make sure it happens without flaws (I’d love to talk to someone who has done it. Send me an email).

Joshua Holt is a former private equity M&A lawyer and the creator of Biglaw Investor. Josh couldn’t find a place where lawyers were talking about money, so he created it himself. He is always negotiating better student loan refinancing bonuses for readers of the site.

Great explanation, I’ve been in the IBR program for 5 years now and work a public service job. After getting married, my concern has been that my wife’s income will disqualify from IBR. This clears up a lot, it may be best to switch to REPAYE.

Drew make sure you run the numbers. Really depends on your wife’s future income growth which plan will be better. @Big Law Investor I’d love to see someone who started off on REPAYE and switched to IBR too, but I’ve yet to meet one. REPAYE is so new a ton of people that I speak with are still on IBR and have never heard of interest subsidies on REPAYE

@Drew – No, as far as I can tell you can’t get kicked out of IBR. Lots of numbers to run to see if REPAYE + MFJ makes sense. They don’t make it easy.

@Travis – I bet there’s very few people that have switched from REPAYE to IBR in order to avoid the payment cap.

Thank you so much for this article — I’ve been under IBR for the last 3 years (am a resident physician) and have been doing the “married filing separately” tax thing due to prior advice (from Dept of Education, the now-defunct GL Advisors (shady AF), and my current loan servicer Nelnet): I was told that even if my spouse doesn’t make more money than I do now, it’s best to always file separately if there’s a chance said spouse will be making significantly more within this 10-year window. Your article seems to argue otherwise — please let me know if I’m interpreting it wrong.

The other issue that keeps coming up is that we’re California residents, and thus are living in a community property state. As such, even if we do file separately, our returns are based on the combined total of our incomes. The last couple years we still paid the extra $$ to file separately based on the prior advice, but once again it came up last week when we were trying to file separately again.

Currently my spouse does not make more than I do (nor has he for the last few years). Next year will be a different story, but I just want to know — could I get disqualified from the PSLF program if some years we file jointly and others separately? I was told at one point that once we’re at a point where his income could potentially disqualify me, I could submit pay stubs to the PSLF instead of our tax documents… now that I say that it seems harder to believe. Would really appreciate any insight you could provide into these matters.

Thanks!!

The benefit of filing separately under IBR is that only your income is used in calculating your monthly student loan payments. Therefore, if your husband has any income, it’s beneficial from a monthly student loan payment perspective to file separately. The problem is that married filing separately has punitive tax brackets (i.e. it’s not the same as two people filing as single) and therefore married filing separately is often worse than paying extra money each month toward your student loans. Unfortunately, it’s a complicated analysis to figure out whether the increase in taxes you’ll pay under MFS is worth the lower monthly student loan payments, but that is the calculation you need to figure out.

On the second point, the Department of Education has issued a statement on the injustice of community property states when it comes to married filing separately. I had to search for this in my archive of notes (glad I found it) but either search for “community property state” in this PDF or go to page 66112 and read “Treatment of Married Borrowers”. Ultimately, the Department of Ed says servicers should use alternative sources of income (like your paystub) to verify your lower income amount (rather than the combined amount of you and your husband).

Your income is not a factor in PSLF forgiveness. Filing as MFJ or MFS also has no impact on PSLF. Those filing designations only impact your monthly payments under IBR. PSLF forgiveness occurs when you make 120 qualifying payments. As I pointed out above, the Master Promissory Note says that you won’t get kicked out of IBR if your combined income gets high enough such that you would no longer qualify to get into IBR (in other words, once you get in you stay in).

Thank you SO much! Incredibly helpful! So glad I found this site 🙂

Any idea where to view or track the number of years being counted towards REPAYE, IBR, other payment plans? Can a late requalification or switching plans wipe the slate and your years counting toward forgiveness start over? I’d like to be able to verify this and I’m sure others would also.

Thanks!

It’s a good question Brock. As far as I’m aware, there is no way to officially track your payments made under any of the income-driven repayment plans other than speaking with your servicer and their records (let me know if you find a more official way). For that reason, YOU are the one that will be doing most of the tracking so I’d keep a record of every payment you made in case there are any disputes in the future.

As far as switching plans, yes there can be implications but generally you’re not going to start the repayment clock over by switching plans as far as I understand. What I’d do is specifically look at which switches you might want to make and why because there are a lot of nuances that you’ll want to research. For example, while it’s possible to switch from REPAYE to IBR, you won’t be able to do that if you’ve started making so much money that you’re past the REPAYE cap (i.e. because you will no longer have a “financial hardship” that qualifies you for IBR.

I’m trying to decide between REPAYE and refinancing ASAP. I think REPAYE is the better option right out of law school, but you always recommend refinancing, so I’d like your thoughts.

First, with the interest subsidy for REPAYE, the effective interest rate under REPAYE is better than many of the private refinancing options. The key reason is that REPAYE takes the previous tax year’s AGI to determine income, which determines discretionary income, which determines the monthly payment. This means that, for the first tax year in big law, for REPAYE purposes, most first-year associates will have income driven payments based an income of $35,000, with a monthly payment of about $140. If one has substantial student loans (e.g., $250,000 at a weighted 6.11% like me), the accrued monthly interest less the $140 monthly payment leaves a lot of interest to be subsidized. In my case, for example, it seems that the govt would be subsidizing about $570 bucks a month, so that my effective yearly interest rate is around (($570 unpaid interest per month) + ($140 paid interest per month)) x 12 / ($250,000 principal)= ~3.4%. And the remaining unpaid interest does not capitalize in the repayment plan either, so the principal isn’t growing even though I’m not even covering the interest!

Second, comparing the effective interest rate under REPAYE and the refinancing interest rate is not apples to apples. If I refinance for a 5 year repayment with First Republic, for example, I’ll get a 1.95% rate. I’ll also be paying almost $5000/month, however, rather than the $140/month under REPAYE. A quick search pulls up a number of high yield savings accounts in which I could park the excess money I would have access to in REPAYE to generate interest to close the gap between the 3.4% and the 1.95%. For example, Synchrony and GS both have a 1.85% APY accounts with no minimum balance. Depending on my risk tolerance I could alternatively use index funds or some mixture of index funds and deposits. For individuals who do not live near a First Republic and therefore may only have access to refinancing options above 3% in the first place, REPAYE seems clearly better.

Therefore, if either way I dedicate $5000/month to my student loans, for the first year in big law, I think it’s smarter to REPAYE and stash, rather than to refinance. Actually, this could also work for the second year in big law, because that year also looks back to your previous tax year’s AGI to determine income and thus monthly payments, and since your previous tax year’s AGI will be determined by a stub year, AGI is probably about the same.

I’m hesitant, however, first because you and many others recommend refinancing. Also, the refinance interest rate is (best case) 1.95% of a decreasing principal (because the monthly payments are in excess of the monthly interest), whereas the 3.3% effective interest rate in REPAYE is of a static principal (because monthly payments under REPAYE are less than the accruing interest). I’m not sure how to directly compare the two, but I know that the market or deposit return I’d get on the excess money I’d have under REPAYE needs to be even greater than 3.4% – 1.95%.

I’m interested to see how Biglaw replies. I’ve usually stuck with the governmental backed repayment programs just in case I lose my job. If you refinance with a private company and something happens to your income, you lose the ability to defer or reduce payments.

We are planning to do REPAYE —> IBR in a few years.

My wife and I are both pharmacists. She had issues similar to those presently up for forgiveness (that the feds are authorizing additional funds to handle) in that she was counseled into “extended payments” and told they would count towards PSLF. She made almost 18 months worth of payments initially and during that time her services was taken over by another..I’m sure everyone has experienced this. We’ve spent hours on the phone trying to obtain the original consolidation loan application documents to no avail.

Anyway, due to the fact that we make similar income, but I’m ~18 payments ahead of her (I am 2022, she is 2024) – we are going to explore switching her back to IBR. In 2021, we will attempt to increase her retirement savings. She is able to contribute to both a 401k and a 457 plan each up to 18.5k. Hoping to then file separately, then after taxes have her submit for IBR using that return. Hoping that her much lower AGI permits her to qualify, and it all gets squared up right before my forgiveness.

If all goes well, my payment will stay the same for those last few months, hers will go up 50% (10%-> 15%..hopefully of a smaller discretionary income due to more retirement savings). Net effect should be to pay a little more for a few months, but when my loans are forgiven, we won’t have to continue 18 more months on her loans looking at our joint income. That would effectively be the same total payment we pay today both on REPAYE, it was just apply 100% to her loan.

I’m currently on IBR and looking for a non-profit job to qualify for PSLF. One thing to note, if you’re employed by a labor union while making the payments, you’re out of luck. In my case I’m so far gone that my minimum payment on IBR is $0 per month. If I secure a job that qualifies, would this minimum “payment” count?

Yes. Any month when your scheduled payment under an income-driven plan is $0 will count toward PSLF if you also are employed full-time by a qualifying employer during that month.

I’m getting married soon and our combined income will disqualify me from repaye. I’m currently in PSLF. I want to switch back to IBR. Our incomes are about the same and the only deduction lost is my student loan interest by filing separate. Do I need to do this before we are married? Or can I wait til the end of the year when it’s time to recertify and ask to switch then? I’m worried if I wait until after we’re married, I won’t be able to switch.

Your plan is to do IBR but married filing separately? For something like this, I’d definitely recommend connecting with Student Loan Planner to get their thoughts. They do this stuff all day every day. I think they provide good advice for a fair price and also may help you think of other options that you’re not thinking about.

Recommend any student loan planners? A degree, I have. Ability to understand what I should be doing, I have not.

I just stumbled across this link because every year when I re-certify I get this feeling of angst because so much seems unknown about the “forgiveness” that results after 300 payments on IBR. I have been on IBR for 7 years and feel like I am beyond the point of no return. I file my taxes separately from my spouse. My spouse is a lawyer and I am an Optometrist. I definitely don’t feel it is my spouses responsibility to take on the stresses of my student debt. I fully recognize that I was an adult when I took out my student loans for professional school but to a certain degree I feel duped by the system bc IBR was fairly new at the time and was being almost pushed as this great program that allowed you to live your life after graduating school without being crippled by giant loan payments. Anyway, I am in a bit of a unique situation because I get payed a daily rate and then get supplemental bonuses quarterly based on a percentage of the professional fees that I bring into the practice. My monthly payment towards loans are insanely low relative to my loan amount because Navient only considers my very low guaranteed daily rate when determining my monthly payment each year since my bonuses can fluctuate based on production. I have put money towards investments to prepare for the ominous “taxable event” that will come after my 300th payment and my balance is “forgiven.” I guess my question is… do I need to be concerned when it comes to my loan forgiveness that the IRS will look back and see that my annual income was far higher than what Navient used to determine my monthly repayment amount? (I submit paystubs). Unfortunately I don’t feel like the representatives at Navient are qualified to be advising me on anything but the are my loan servicer and they assure me everything I am doing is legit.

Unfortunately, I don’t think there’s a solid answer to your question. FedLoan had been certifying a bunch of people as meeting the requirements to be included in the Public Student Loan Forgiveness program and then later the Department of Education changed its mind and told them in reality those payments didn’t count.

Which is to say that I don’t think anyone can tell you with certainty that the IRS or someone else might look at your situation in the future and decide you weren’t paying enough. That said, given how all these programs are run, as long as you are following the instructions provided for your servicer and providing them with all required information, it seems unlikely they will have the resources in the future to audit and review those decisions later (not to mention how patently unfair it is for you to be following their instructions and for them to later decide that they made a mistake in telling you how much to pay).

Like all student loan forgiveness matters, the key here is that you should be keeping impeccable records. I would have a folder on your computer (backed up of course) that has every single payment you’ve made, has every piece of information you’ve submitted to Navient, etc. You do not want to be in a position when you’re at payment 299 and you’re scrambling to find records from 15 years ago.

Honest question – why are you pursuing forgiveness? I assume you’ve run the math but is it really a better deal to seek forgiveness with the accompanying tax bomb than to just pay off the loans?

I pursued IBR because of the way it was presented to us upon graduating school. I had over 240K in with an interest rate of over 6%. In a standard repayment program my monthly payments would have been over 2K. The monthly interest alone was about 1500 dollars. IBR allowed me to start my life (buy a home, feel comfortable starting a family, save and invest money). It allowed me to spread out the “hurt” in a way that a standard repayment would not. I’d be living like a student for the next 20 years in standard repayment. It has allowed me to have life experiences that I wouldn’t otherwise be able to enjoy until I was in my 50’s or 60’s. I hope to live until well beyond that but who knows what tomorrow brings. All I know is that I’ll be on my death bed being thankful for the experience that I’ve had not saying to myself “Man! So glad I worked myself to death for 20 years to be debt free in the student loan department.”

Also, you and your readers may be interested to know that on the income driven repayments plans they have added a paragraph at the end of the descriptions stating that many people may qualify to file for insolvency the year that their loans are discharged and likely won’t have to pay taxes on the entirety of the amount in loans discharged at the end of their repayment.

I ran across this site while doing loan research for a family member who recently graduated from Pharmacy school with about $225k in loans and is now in a 2 year clinical Pharmacy residency (grace period expiring Jan). They are trying to decide between PAYE and REPAYE. Currently single, but likely to be married after residency. Their combined income after residency would be around $200k. With PAYE the concern has been that they will be put into a 10 year Standard plan at some point down the road during those 120 payments, and lose the PSLF being pursued. (Ex. Suppose at the time of requalifying and already made for example payment 80 or 100 of the 120 payments in PAYE that the amount would be higher than 10 year Standard, so they would be required? to switch to 10 year standard and lose PSLF qualifications). Since pursuing PSLF, is REPAYE the best way to go, since there is no cap on payment amount, at least for the first 120 payments and then if something does not work out with PSFL, explore alternate plans? I think I read that it is unlikely in todays REPAYE that it would exceed 10 year standard – is that your experience also?